Ask a Fixer is a live ASUG-hosted Q&A session with one of ERPfixers’ top-rated SAP experts (“Fixers”) in a specific module or topic. In this real-time discussion session, you have the opportunity to pose your specific questions to a Fixer, who will provide an immediate answer during the forum. This is a great way to get quick answers to your pressing issues, as well as learn from questions posted by other users during the forum.

SAP Net Present Value/Mark-to-Market

Many users wonder how SAP calculates the Net Present Value or Mark-to-market figures in transaction JBRX. This post seeks to help users gain an understanding and interpret the results that are generated when one executes the transaction.

Background

An investment transaction generates a series of future cash-flows and the Net Present Value (NPV) is the present value of future cash-flows.

Example

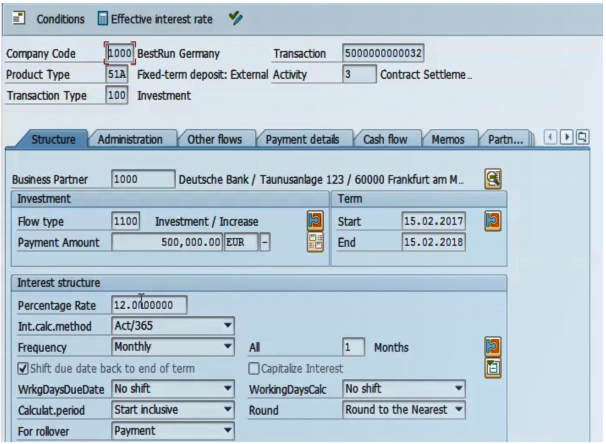

Invest in a €500000 Fixed Term Deposit for one year at a monthly interest rate of 12%.

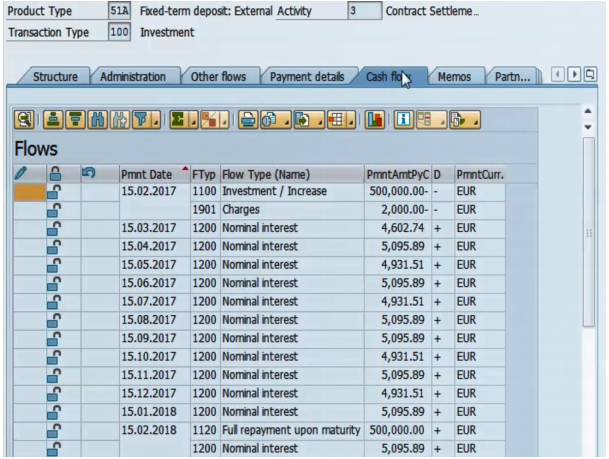

Cash-flows are calculated as below:

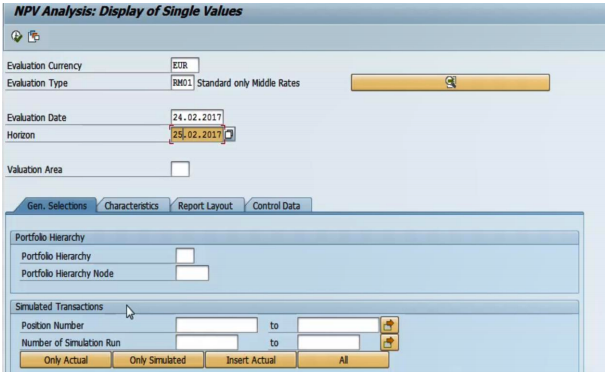

To calculate the NPV use transaction code JBRX.

On the selection screen, enter the following information:

Evaluation Currency

Evaluation Type- This carries the relevant evaluation parameters that will be used in the calculation of the NPV.

Evaluation Date- This is the date that determines the market data that will be used in the NPV calculation.

Horizon- This is a future date on which future cash-flows are discounted. The horizon date must be greater than the evaluation date.

You can also select to run the NPV analysis using simulated transactions and you can limit the NPV Analysis bases on different characteristics, for example transaction number.

Once you are happy with your selection criteria, you click Execute.

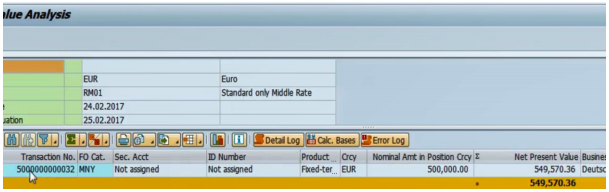

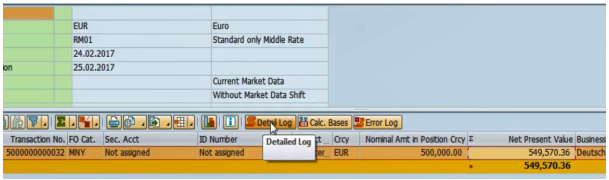

The system now displays the transaction which we entered in the selection characteristics and both the Nominal amount and the NPV amount are displayed as below:

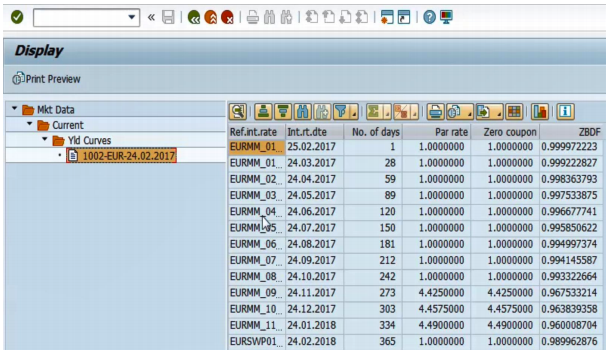

Highlight the transaction and click on Detail log to view the yield curves that have been used in the NPV calculation. The Yield Curve Framework is used to maintain reference interest rates and enter their values. On the basis of the reference interest rates, you can create yield curves to help you determine mark-to-market net present values with the price calculator.

This transaction will be discounted based on the reference interest rates maintained on yield curve 1002.

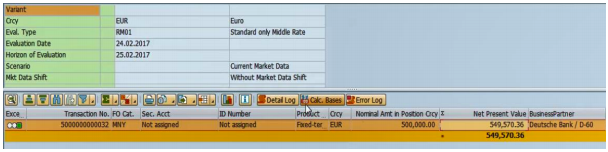

For detailed calculation parameters, click on the transaction again and select the icon Calculation Bases.

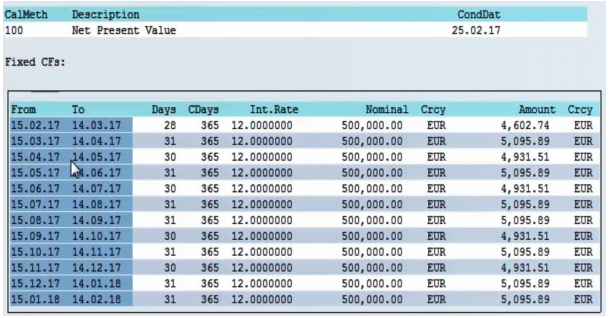

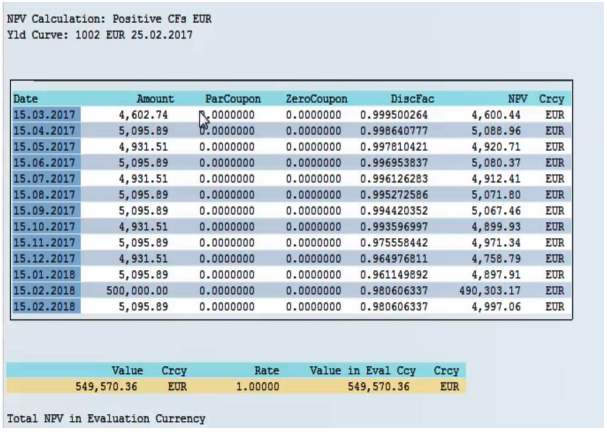

The Calculation Bases screen first shows the fixed cash-flows based on the fixed interest rate of 12% maintained on the transaction. The cash-flows are calculated based on the Interest calculation method specified on the transaction, Act/365 in this case. For the first cash-flow calculation would be: €500,000.00*12 %*( 28/365) =4602.74.

For the NPV Calculation, the system takes the Discounting Factor calculated based on the 1002 yield curve values and applies that to the fixed cash-flow. For the first line, the calculation would be:

€4602.74*0.9999500264= €4600.44

These discounted cash-flows are then added up and the total NPV of the transaction is €549,570.36.

Q&A: FIN REVENUE RECOGNITION - With the Deadline Looming, Are You Ready?

Get answers to the following questions in this co-hosted ASUG webcast:

This presentation focused on the use of RAR. But that has only been generally available since Mar, 2015. How many customers are actually using RAR? What about the rest (assumed to be the majority) who are using "old" functionality like basic SD Rev rec?

In your opinion, how long should the project be for a fortune 500 company to implement RAR, the right way?

What is software requirement to have implemented RAR in SAP ECC6 EHP6?

Do companies seem to be also changing all of their internal and management reporting and metrics or do most companies appear to only be changing their external SEC reporting to align with the new standard?

How does/can RAR handle revenue recognition based on estimates, when customer actuals are submitted a quarter later?

For a mining company with sales restricted to few customers, do you think RAR is a scope?

RAR requires a separate license, correct?

What all criteria need to be met for the company to be required for this reporting?

Watch the prerecorded webcast by pressing play:

Is your Contract Roll-Forward external disclosure report ready?

When is your ASC606 US Adoption Rate?

Introducing New Asset Accounting in S/4 HANA

Get the background on New Asset Accounting and S/4HANA, and run through some of the key changes that were introduced which distinguish it from Classic Asset Accounting. Next, we will go into some more detail on some of the larger areas, for example how the depreciation areas work with the ledgers to record the different accounting principles. You may already have heard of the Universal Journal, which is one of the biggest innovations in Finance in S/HANA. We will explain what that is and how New Asset Accounting integrates with it and how the new asset transactions work. I will also run through the depreciation and finally I will briefly touch on the migration of assets.

SAP Bill of Materials

Learn about the use of bill of materials in a PLM context. Material BOM types, the elements at header and item level and how it can be used in a PLM context.

Ask A Fixer: FIN REVENUE RECOGNITION - With the Deadline Looming, Are You Ready?

Ask a Fixer is a live ASUG-hosted Q&A session with one of ERPfixers’ top-rated SAP experts (“Fixers”) in a specific module or topic. In this real-time discussion session, you have the opportunity to pose your specific questions to a Fixer, who will provide an immediate answer during the forum. This is a great way to get quick answers to your pressing issues, as well as learn from questions posted by other users during the forum.

SAP Functional Optimization

Need and ways to optimize your SAP system.

- How customers have suffered from a lack of proper utilization of SAP.

- Examples of how a deviation from Best Practices could adversely impact an organization.

- Methodology that should be used when performing an optimization project.

- How a proper system optimization will help companies with migrating to S/4 HANA 5.

Q&A: What you should know about New Asset Accounting with S/4 HANA

Q: If you do not currently use the Fixed Assets module in SAP, and you are planning on moving to S/4 HANA, is it better to implement Fixed Assets before you move to S/4 or after?

A: Assuming that you are on SAP, it depends whether you have the new GL or not (as New GL is a pre-requisite for New Asset Accounting), whether you plan to have additional accounting principles, and whether you are converting to S/4 HANA on-premise or doing a Greenfield implementation, which version you are planning to move to and when. Uploading an excel file with batch processing via the LSMW is not available at the moment on-premise, but you can use a BAPI. An asset upload is usually easier at a year end. If you are already on NewGL and planning to convert to S/4HANA at a year end, it may be easier to get the asset upload out of the way before the S/4 HANA migration. In all cases I would get expert advice to examine all the facts before making a decision.

A: The fiscal year end of asset accounting must agree with the fiscal year end of Finance, (even if the periods differ) but how can you map a depreciation area with one fiscal year end if you have a different fiscal year end for the parallel ledger in finance?

Q: Lets say you have 0L with March year end and 2L with Dec year end. Create a new ledger e.g. NL with March year end and add to a new ledger group so the new ledger group has both 2L and NL in it and mark NL as the representative ledger and map the depreciation area for the Dec year end to the new ledger group. This should allow you to post from asset accounting to a different year end in finance.

Q: Can you map depreciation areas to appendix or extension ledgers in finance?

A: No this cannot be done at the moment. The extension ledger posts only delta postings in finance.

Q: If you have an asset with different useful lives for example for local GAAP and IFRS, so that the total depreciation calculated to date is different, and you make a sale to a customer, how does the system post the different values to different ledgers, but the same amount to the customer?

A: The system will automatically use the technical clearing account in a similar way to an acquisition to post the different values in different ledgers.

Q: Can you set up asset accounting with Central Finance on S/4HANA?

A: FI documents from Asset Accounting that are sent to Central Finance are only replicated as FI documents and not currently as fixed assets, and some of the fixed asset information may be removed. Therefore, although in the source system, the APC and accumulated depreciation accounts are set up as reconciliation accounts, in the SAP S/4HANA Finance system, they are not and accept only finance postings.

Q: Is it beneficial to implement new asset accounting prior to upgrading to S/4 Hana?

A: Assuming that you are on SAP, it depends whether you have the new GL or not (as New GL is a pre-requisite for New Asset Accounting), whether you plan to have additional accounting principles, and whether you are converting to S/4 HANA on-premise or doing a Greenfield implementation, which version you are planning to move to and when. Uploading an excel file with batch processing via the LSMW is not available at the moment on-premise, but you can use a BAPI. An asset upload is usually easier at a year end. If you are already on NewGL and planning to convert to S/4HANA at a year end, it may be easier to get the asset upload out of the way before the S/4 HANA migration. In all cases I would get expert advice to examine all the facts before making a decision.

Q: For parallel ledgers with differing fiscal year variants, is the migration scenario mandatory for new primary ledger with same fiscal year variant as leading ledger? Or, can new primary ledger be treated as a "technical ledger" only?

A: I think you can use the representative ledger box to get round this. Lets say you have 0L with March year end and 2L with Dec year end. Create a new ledger e.g. NL with March year end and add to a new ledger group so the new ledger group has both 2L and NL in it and mark NL as the representative ledger and map the depreciation area for the Dec year end to the new ledger group. This should allow you to post from asset accounting to a different year end in finance.

Q: Each currency needs separate Dep. Area. Can you please elaborate this from with current ECC EHP6 scenario?

A: It is the same principle as in ECC6, if you have two currencies in finance for a ledger you will need two depreciation areas, one for each currency, for that accounting principle. The main difference is that you no longer need any delta depreciation areas.

Q: How is archiving of FI_DOCUMNT impacted?

A: Not sure if this is a question about new asset accounting or asking if an S/4HANA migration affects already archived documents, or how documents are archived on S/4HANA.

Q: Where do you configure technical clearing account? In AO90 - Asset account determination, or somewhere else? Can you please specify.

A: You cannot configure the technical clearing account in AO90. It has its own section in the New Asset Accounting section under Integration with General Ledger Accounting in the IMG.

Q: I heard a new year could not be opened independently in both Finance and Asset Accounting and is done in a single t-code which is balance carry forward. The carry forward transaction to open the new year can’t be processed if the previous year hasn’t been closed. Does this mean that AJAB closing asset has to be performed before we open a new fiscal year?

A: It is correct that transaction FAGLGVTR, which is the general ledger carry forward is now used for asset accounting as well. However it only opens the new year and you can continue to post to the old year. You should not need to close the old year with AJAB before opening the new year. (In ECC6 i have seen the old year closed 10months later in one company).

Q: If LSMW doesn't work, will tools like WinShuttle or SHDB work?

A: It depends on the version of S/4HANA - I believe the Cloud version has its own tools. For on-premise you can use a BAPI, or transaction AS100 if you don't have too many items, or can split the upload into 2 or 3 uploads.I have not used either Winshuttle nor SHDB to upload to S/4HANA, the Winshuttle website mentions Certified S/4HANA integration including the 1610 version, but I don't know about SHDB.

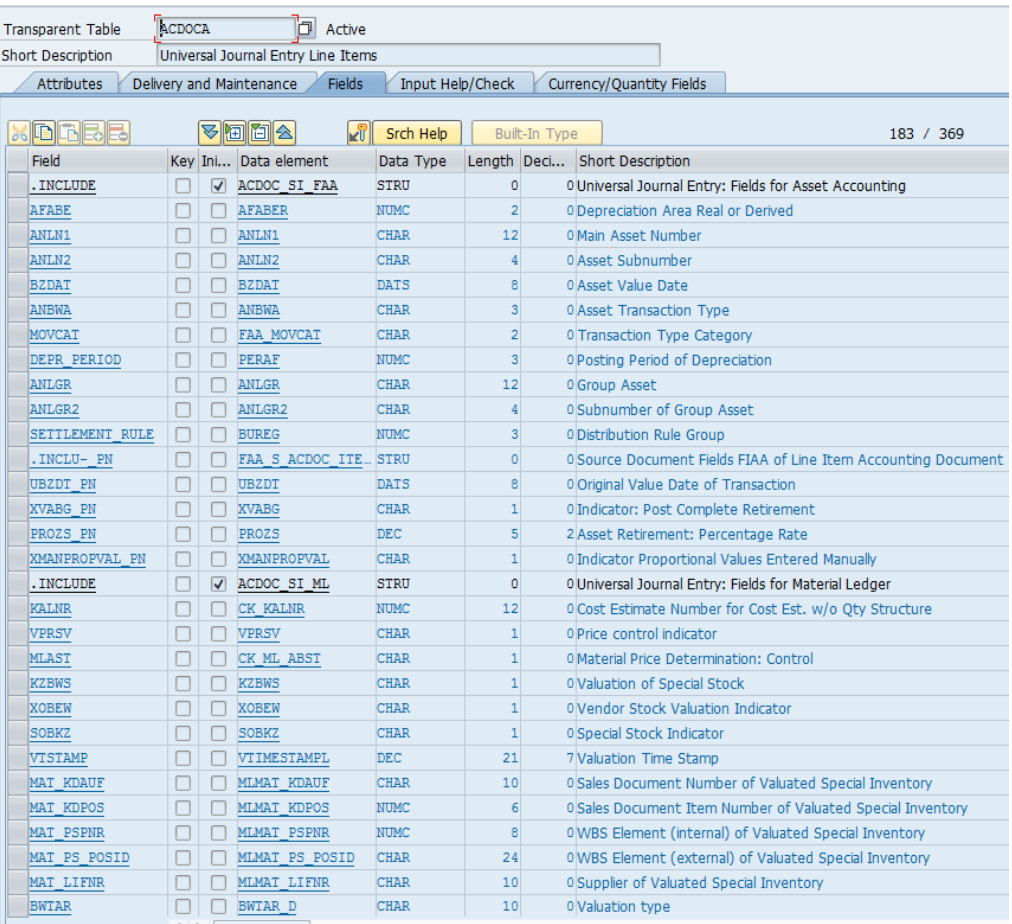

Q: For Depreciation areas that do not post to FI where is the data kept and what does it look like what tables do reports run against? Is it held in ADOCA and marked as statistical in some way?

A: ACDOCA contains actual data by ledger and therefore if a depreciation area is not mapped to a ledger it can't record data from it. FAAT_DOC_IT will contain statistical data. Most of the asset reports can be run by depreciation area so you can see data in the asset module for all the depreciation areas in the same way.

Q: Can we change accounting principle on a depreciation area after the initial migration?

A: During the migration you may need to do some changes to the configuration, but if you want to point one depreciation area at a completely different ledger, It would be best to check with SAP as I am not sure of the consequences.

Q: Can we still use calculated depreciation areas in S4 still posting to ledge?

A: Yes, although as with most of my answers, you should carry out extensive testing to make sure that the results are as you expect.

Q: FYI: LSMW is still officially supported for RE and FI-AA legacy conversion. It just requires that you use the BAPI_FIXEDASSET_OVRTAKE_CREATE rather than a screen recording. Note 2208321 has more information.

A: In the Simplification List issued for the S/4HANA 1610 release, it states: ""The LSMW (Legacy System Migration Workbench) function is still available within SAP S/4HANA, (onpremise edition) but not considered as the migration tool. LSMW might propose incorrect migration interfaces that cannot be used in SAP S/4HANA anymore. The Legacy System Migration Workbench (LSMW) is an SAP NetWeaver tool for data migration that was first introduced with R/2 to R/3 migrations. It uses standard interfaces like BAPIs, IDocs, Direct Input and Batch Input programs and recordings. Due to this nature, the use of LSMW is restricted for migrations to SAP S/4HANA. The Legacy System Migration Workbench (LSMW) can only be considered as a migration tool for SAP S/4HANA using workarounds and careful testing for each and every object. The use of LSMW for data load to SAP S/4HANA is not recommended and at the customer's own risk. However it then goes on to quote the OSS note 2208321 for one of the workarounds - hence the confusion.

Q: Will you still have the tax deprn available for reporting?

A: If I understand the question, if you have a tax depreciation area set up and you keep that tax depreciation you should be able to continue to report on it after a migration.

Q: Pease could you confirm. I believe you said migration had to occur at fiscal year end and that you could not reopen the prior year once the migration was over. Our tax only books are often re-opened for the prior year.

A: I believe a New GL migration has to occur at a fiscal year end, but an S/4HANA migration, can occur at any period end. If I mentioned a closed fiscal year could not be re-opened after migration I was referring specifically to a closed fixed asset year end at the time of migration.

Q: Does HANA still support multiple Chart of Accounts? Or are these now unified into a single CoA?

A: If you mean for example an operating chart or accounts, local chart of accounts or group chart of accounts, then they behave the same in S/4HANA. You still have the option to add a local chart of accounts to the company code in global parameters and enter the alternative account number in the GL account master data.

Q: We have to report by tax jurisdiction and have the tax jurisdiction on the asset will that still be there?

A: The tax jurisdiction field is still available in the asset master data.

Q: Is it possible to add parallel ledgers at the same time as S/4HANA migration?

A: You cannot add parallel ledgers during the migration. I understand that adding parallel ledgers once on S/4HANA is now available since version 1610 on-premise.

Q: Could the AP invoice in the example have been posted w/ different amounts by ledger?

A: The initial AP invoice would have the same amount for each ledger, so for example the whole amount in one ledger could be capitalized and the whole amount in the other ledger could be expensed, but if you wanted to transfer part of the amount to say shipping costs you would need a subsequent journal using FB01L or AB01L posting to just the one ledger.

Q: It seems in 1605 you must add then parallel ledger in separate year. can you do it in the same year as migration then with 1610?

A: I think it would be safer to check with SAP as I am not 100% sure of when the parallel ledgers can be added.

Q: We calculate tax depreciation each month and report it at the end of the year the the taxing authority we have a special tax depreciation area.

A: I see no reason that this would not work on S/4HANA although would need more detail to be sure what the exact question is.

Q: Can you open the new year with a pending new project adding a parallel ledger?

A: I think it would be safer to check with SAP as I am not 100% sure of when the parallel ledgers can be added.

Q: Heard that carry forward is only needed one time and will update automatically after performed if posting is made to prior year in the ledger. is this correct?

A: This is the carry forward transaction FAGLGVTR - this is how it worked in ECC6 and as far as I am aware should work the same in S/4HANA.

Watch the prerecorded webcast by pressing play:

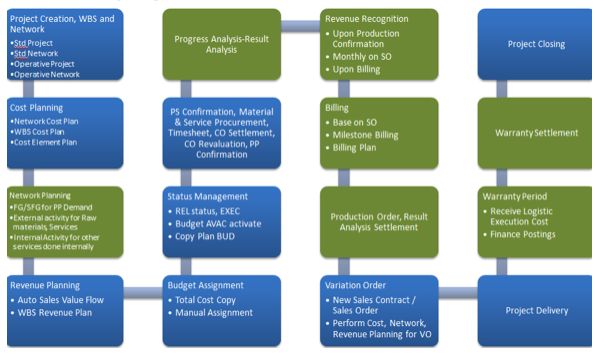

SAP PS Functionality and Integration

This article covers the basic functionality of Project Systems and how it relates in MRP to PS and other logistic integration.

Project System is a highly integrated module whose purpose is more for consolidation and reports.

As its name suggest, it is project oriented, something that has a timeline and will end that you want to track by breakdown basis. Though there are cases where we can just make the project as a receiver for a departmental cost for example, RnD of 2016.

There are 6 main setups for PS

Costing – Project that exist only for the purpose of planning costs at WBS level.

Assets – Project that receive Capital funds from Investment Programs.

Sales – Project that are customer focused.

Manufacturing – Project that are Material / Logistic focused.

Statistical – Project that do not plan or receive costs.

Maintenance – Project that exist for managing Equipment.

Different setup caters for the different industry and usages of the module. Each will have a different configuration and integration with other module. In terms of functionality, PS is used to:

Receive and consolidate Costs and Revenue in WBS (leveled and labeled) manner. A WBS is a CO Object, thus can be a receiver for settlement.

Act as Planning tool for project schedule

Act as demand management

Act as investment and asset management

For logistic execution in term of procurement and scheduling.

For No 2, companies will normally use MS Project to do the scheduling and interface it with SAP PS. There is also a standard interface available that can easily integrate these two applications (Open PS)

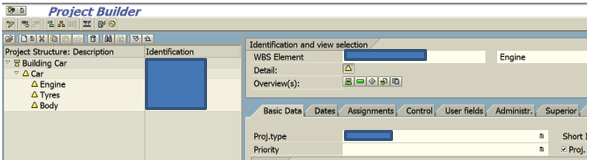

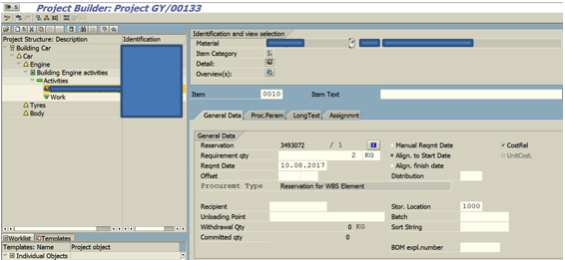

To illustrate the core functionality of Cost & Revenue allocation, (example above) where you want to categorize the cost of building a car into 3 categories. You can easily separate and are able to see the breakdown of the cost of the car by building this structure.

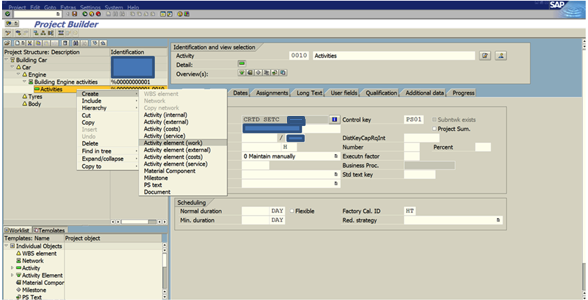

You can then attach a network to the engine WBS. With this network we can create activities which enable the creation of elements, where the logistic activities are maintained, as you can see in the picture above.

Work – Defines the internal work done by your own labor. This will use a Work Center and activity type to determine the cost. The rate can be maintain in KP26 (Activity type/Price Planning).

External – Defines the external work done by contractors, outside the company. This will require Vendor, Outline Agreement(optional) and cost element. Price is maintained manually.

Costs – Defines auxiliary costs. This will use a cost element and cost is entered directly.

Service – Defines work/ services using a service master.

Material Component – Specifies the activity requires a Material, and demand will be entered. Based on the MRP View 2 – Procurement Type, purchase requisition / planned order will be created.

By putting the Material component into the network activity, it will act as a demand for the material.

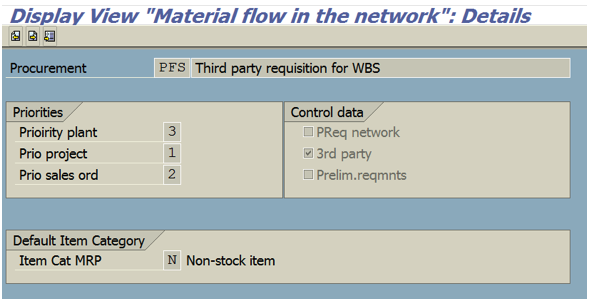

There are 5 default standard options to choose from

PEV will enter the demand as PIR and become stock for the WBS.

PF will trigger purchase requisition its for non stock. Meaning it will be consumed upon GR.

PFS is the same as PF, except its to be deliver directly to the customer or an address. You can choose to select customer address / vendor address or any location from central address management.

PFV will enter the demand as PIR, but its non-stock.

WE will also enter demand as PIR, stock item, at Plant level.

You can see the config in SPRO-Project System-Material-Procurement-Define Procurement Indicators for Material Components.

By putting 2 KG Demand with requirement date 10.08.2017, it will transfer as a PIR and we can view in MD04 as below.

Run MRP and the system will generate procurement proposals.

For investment and asset management, it is mostly used in Oil and Gas industry where the project is a AuC (Asset under construction) which when completed, will become Fixed Asset and starts depreciation.

In conclusion, Project System core function is for Revenue / Cost reporting, however it also can be integrated with logistic functionalities and from there derives the project in all aspects. It’s a highly useful module for a company that operates on Project Basis. Below is an example of Customer Project Setup (uses Cost, Sales and Manufacturing setup).

Project created with WBS and network. Cost planning, logistic, revenue are done. Baseline budget is set and project is executed. Project runs and confirmation, Goods Receipts starts. This will be repeated until project ends. From there customer can be billed based on the Sales Order using Milestone/Billing plan. Settlement done at the end for closing. If additional items are requested from customer, the whole process will retrigger with different SO and WBS (can be in the same project). After project delivery, warranty period will starts and any cost incur will be collected under warranty. Warranty ends and settlement is done at the end of the project closing.

Ask A Fixer: What you should know About New Asset Accounting with S/4 HANA

EXCLUSIVELY FOR ASUG MEMBERS!

Start: Wednesday August 23rd, 2017 1:00 PM (CT), 2:00 PM (ET), 12:00 PM (MT), 11:00 AM (PT)

End: Wednesday August 23rd, 2017 2:00 PM (CT), 3:00 PM (ET), 1:00 PM (MT), 12:00 AM (PT)

There are several changes that have been made with S/4 HANA Finance. One of the major ones is with the introduction of New Asset Accounting which provides new data structures and enhanced functionalities that allow you to manage and monitor your fixed assets. Attend this webcast and live Q&A with Oona Flanagan, ERPfixers Expert and author of the new SAP Press E-bite “Introducing New Asset Accounting in S/4 HANA”, to learn more about the following:

- Key changes introduced with New Asset Accounting

- Depreciation Areas and Ledgers - how they work now

- Integrated Asset Postings and the Universal journal

- How Depreciation runs in New Asset Accounting?

- Migrating to New Asset Accountin

SPEAKERS:

Oona Flanagan, SAP FI/CO Expert

WHAT IS "ASK A FIXER" WEBCAST SERIES?

Ask a Fixer is a live ASUG-hosted Q&A session with one of ERPfixers’ top-rated SAP experts (“Fixers”) in a specific module or topic. In this real-time discussion session, you have the opportunity to pose your specific questions to a Fixer, who will provide an immediate answer during the forum. This is a great way to get quick answers to your pressing issues, as well as learn from questions posted by other users during the forum.

If you cannot attend: The webcast will be recorded. The link to the recording will be posted here and emailed to all registrants.

Q&A: What You Should Know About Profitability Analysis With S/4 HANA Finance

Get answers to these questions:

How Account-Based CO-PA is integrated with the Universal Journal

The considerations to be taken into account when converting from Account-Based to Costing-Based CO-PA

How to perform realtime derivation in CO-PA and reduce the need for month-end settlements

The setup needed to break cost of goods sold into cost components using Account-based CO-PA

How CO-PA allocations work with the Universal Journal

Watch the prerecorded webcast by pressing play:

To be a Savvy Professional You Need SAP Training

By Lori Moriarty at Michael Management Corporation

If you want to stay relevant as a technically savvy professional, you need continuing SAP training.

Why?

Because SAP is the 500-pound gorilla of ERP software. According to SAP they have over 350,000 customers in 180 countries and 15,000 partner companies worldwide. 87% of Forbes Global 2000 are SAP customers. There you go. Odds are high that you are going to be working for a company that has SAP.

Are you currently an SAP end user?

Great. Now it is time to be trained. Many companies use peer-to-peer training methods to get the new end users up and running. Though it may be enough to get the job done, there is so much more to learn. Imagine being able to use menu short-cuts that you did not know exist. With proper training, you can become your department’s Super User and position yourself for a promotion or raise based on your new level of proficiency. There may be a better (i.e. faster) way to do your reports and queries. You may never know these processes exist until you take an SAP training course.

Looking for a new position or a new job?

Your supervisors and future hiring managers will look at your SAP qualifications. Yes, of course, it is great to have experience as an SAP end use user. It is even better to show you went above and beyond and got professional skills training. You can take training for your specific career field. If you are in the human resources field, then earn a certificate as an HR Administrator, HR Manager or HR Payroll Manager. This kind of training is what will put your resume above the rest.

Want an impressive resume on LinkedIn?

Then just upload that hard-earned SAP Training certificate and let them know exactly how serious you are about your career. When you become a Certified SAP Professional, your credentials can be verified on-line by a third party. Remember to continuously update your LinkedIn profile as you change positions and take on more job duties. Reach out to others in your field and build your network because you never know who may be hiring. When you add your new SAP Certification be sure that your “share profile changes” button is in the ON position so that everyone can see your updates.

How would you like to make more money?

According to PayScale.com SAP Certified consultants earn more than consultants without certification. 137 consultants with SAP training reported their earnings at $75K to $126K and 122 SAP consultants who did not have SAP training or certification reported $49K to $78K. Does this mean that the consultants without training are bad? Of course not, they may be even better at the job than some of the higher paid consultants. The point here is that perception is key. More training looks better.

What is motivating you to start continue your SAP training?

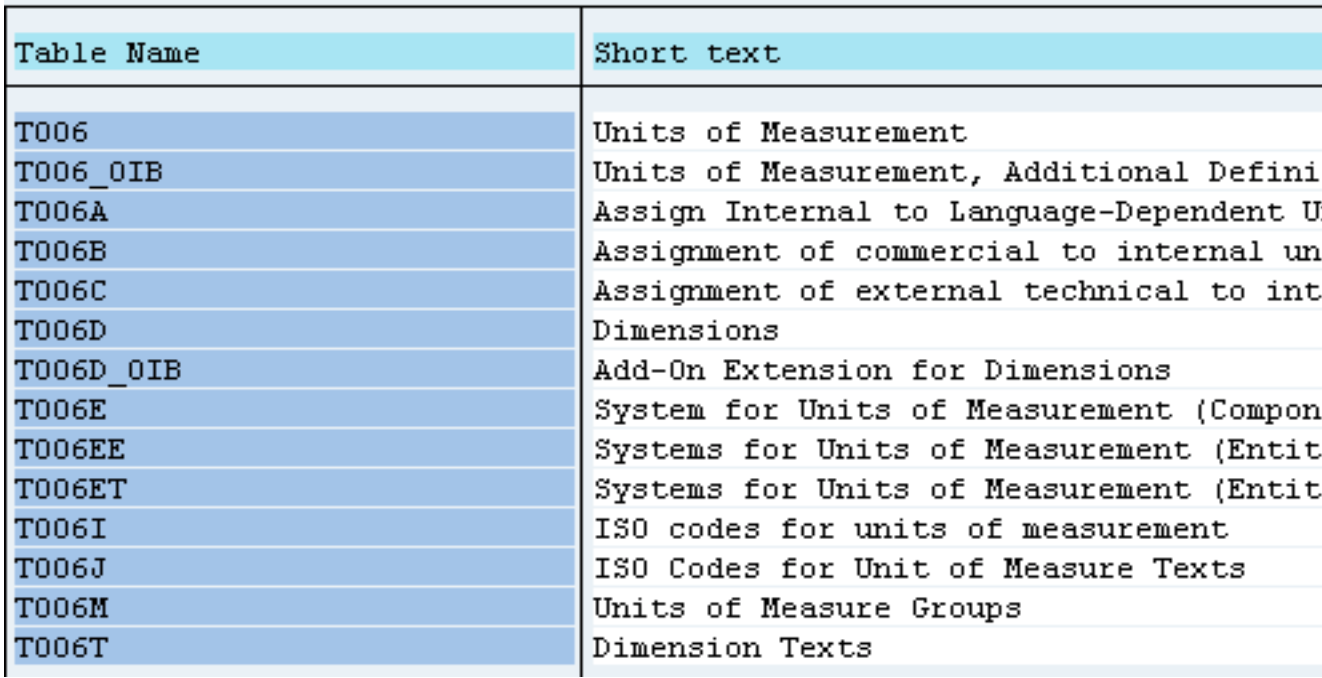

Units of Measure and Their Behavior Inside Custom ABAP Code

One topic that is important in SD, but is often overlooked is the use of units of measure in custom ABAP programming. In SAP, units of measure are stored in a series of tables that begin with T006:

The table which controls various language translations of a unit of measure is table T006A. I’ll explain more on that shortly.

SAP does a lot of work behind the scenes that most developers rarely ever see. When calling up any item in SAP, a delivery for example, SAP will perform conversions of their data before displaying it to the user. This is done for several fields, but one of those fields is the unit of measure of the delivery item. SAP will convert the unit into what’s known as the external, or commercial unit of measure. This is the unit of measure that is displayed to the user. On the flipside, when a user enters a unit of measure into the delivery item and saves that data, SAP assumes that the user is entering the unit as the external or commercial unit of measure and will convert that entry into the internal unit of measure, or the unit of measure that is stored in SAP.

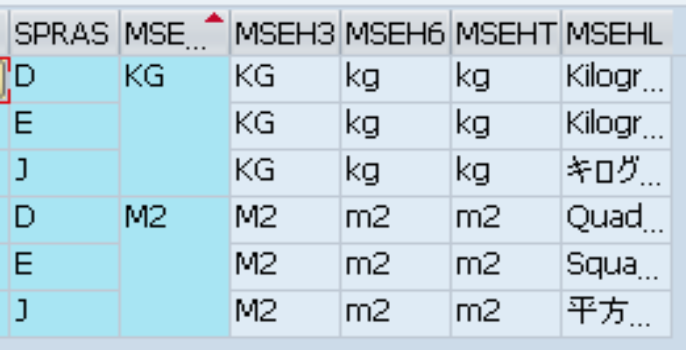

The difference between the internal and external units of measure are sometimes very hard to distinguish as they often look the same in English. What it boils down to is that the internal unit of measure is language independent, meaning that it is the same in ALL languages. The external or commercial unit of measure varies depending upon the language it is being viewed from. A developer may never know this when dealing with units such as KG or M2 because these are typically stored the same way in all languages.

In the example above, the first unit is the internal unit, while the second unit (MSEH3) is the commercial unit. Both the internal and commercial units are the same in all languages. The problem begins to occur with units that vary in different languages.

One example is a crate. In German, a crate is “Kiste”, so the internal unit of measure is “KI”. Since SAP is a German system, the commercial unit is also “KI”. However, in English, we would not identify it as a “KI”, but rather something like “CRT”. We now have a difference. Also, in this example, the Japanese unit is in kanji:

One mistake a developer may do is create a custom field using the external, or commercial unit of measure. Another is to define a unit of measure variable as a CHAR3 with the intent of writing this value to a text file. This will cause the field to take the form of whatever is found in the table. If a user has pulled this data straight from a delivery and writes it directly to the CHAR3 variable, SAP hasn’t converted that text yet, and because the data has been assigned a variable without a conversion exit, it never will be converted.

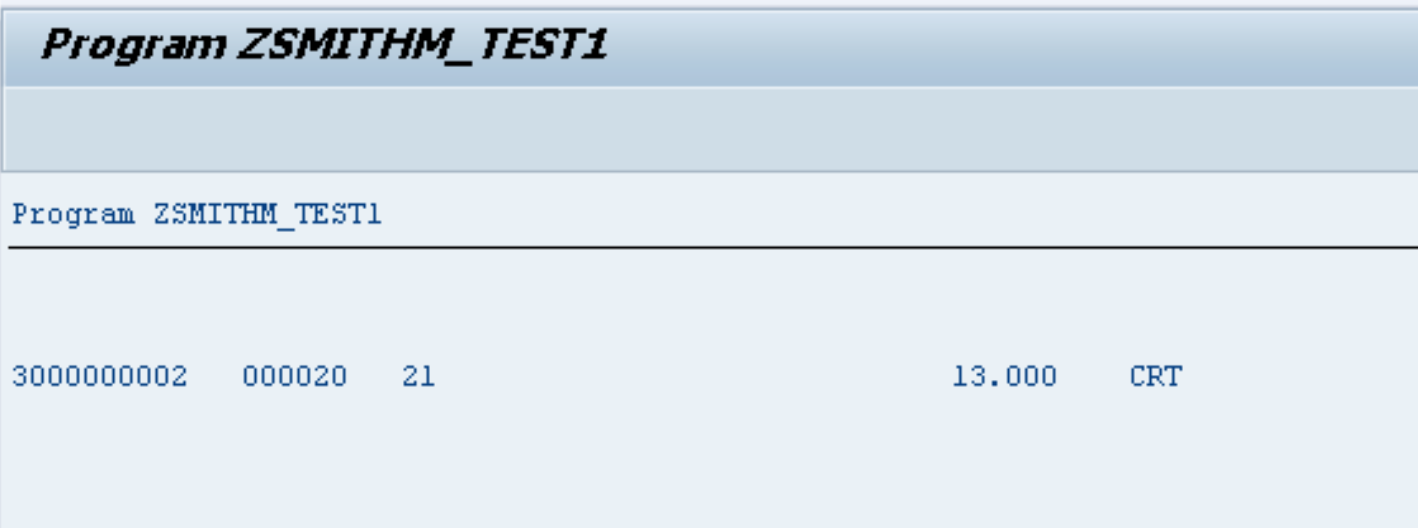

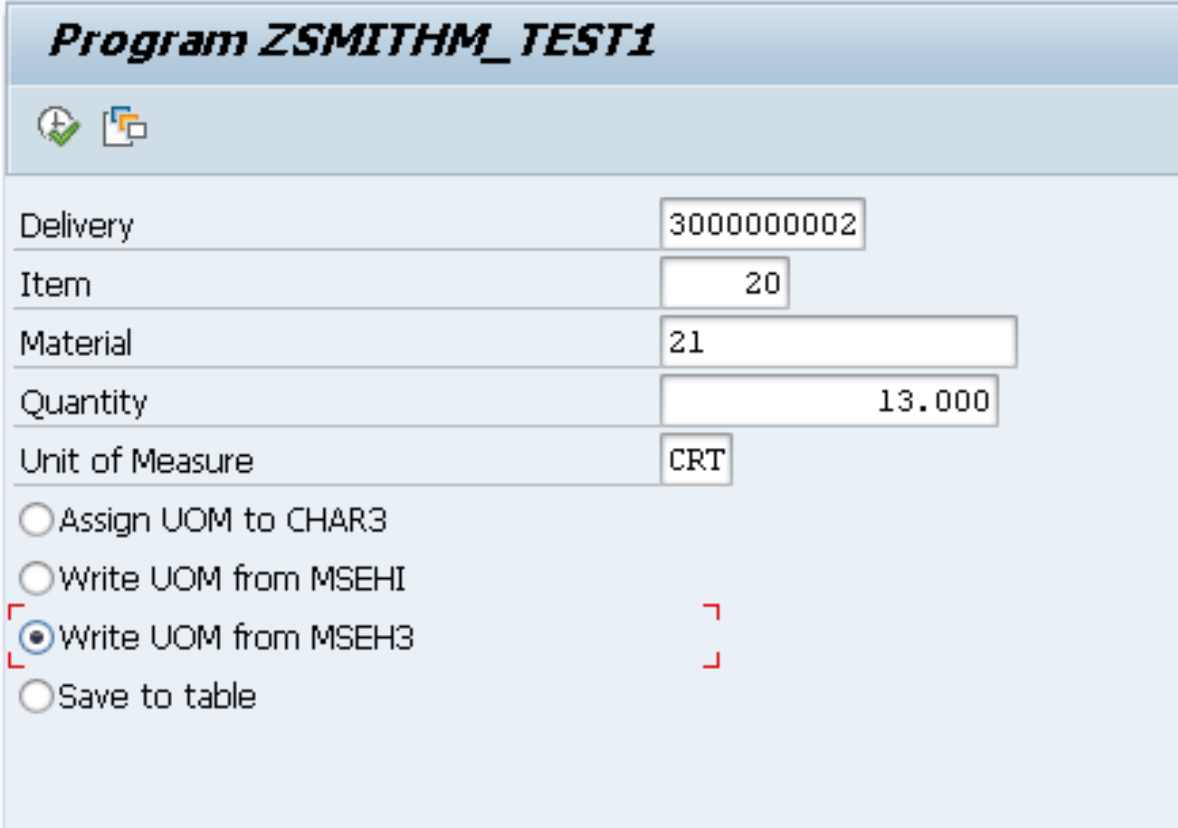

For illustration purposes, I built a custom program and table. This program takes an input, and writes the data to the screen. Here are few examples.

Note that I’ve entered the commercial unit of measure here.

What just happened? The unit of measure was converted when assigned the field in the table to be added to the database, however, when it was written to a character variable, it was not converted back before output.

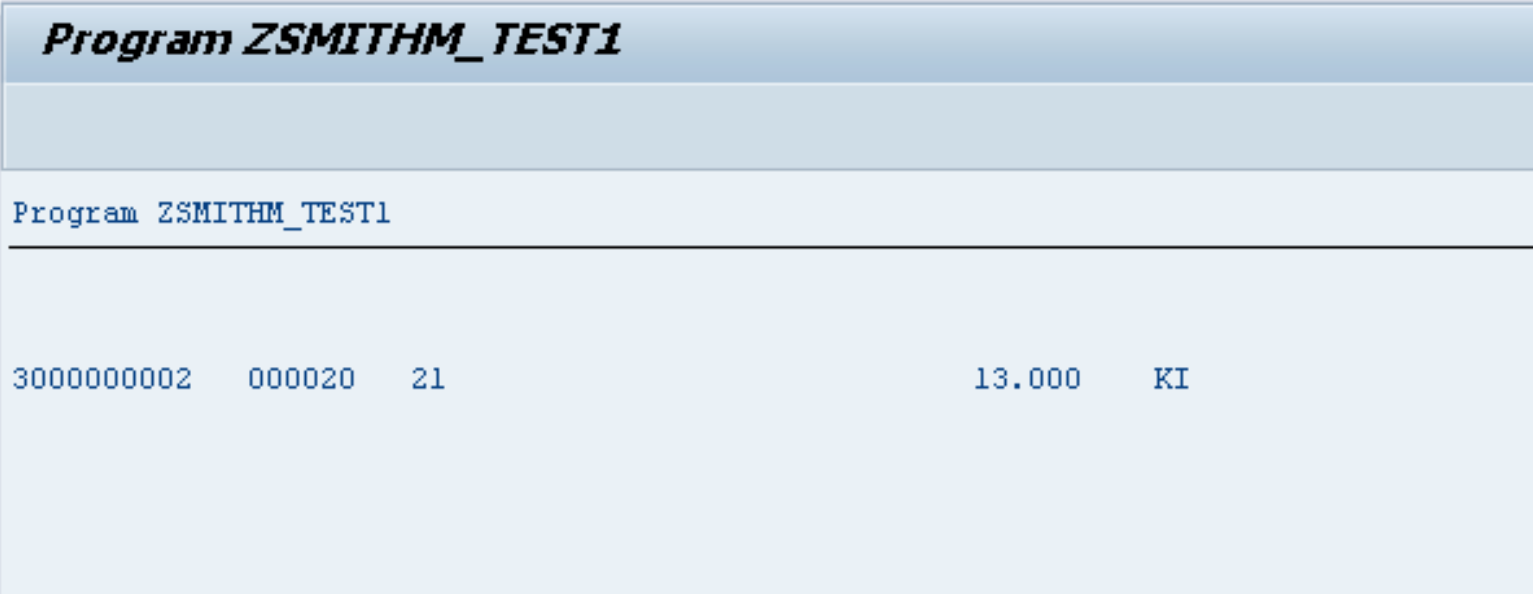

This example writes the unit of measure from the internal unit of measure field

Again, what happens here is that SAP converts it to the internal unit so that it can store the correct value in the table, however, before it is written to the screen, it is converted to the commercial unit of measure automatically.

Simply put, the reason this happened is because the commercial unit of measure (MSEH3) does not contain a user exit. Therefore, when the converted unit of measure is assigned to this field, it is currently in its internal format, and does not get converted to it external format. The issue is that SAP will not automatically perform this conversion when assigning values to variables without the proper conversion exit.

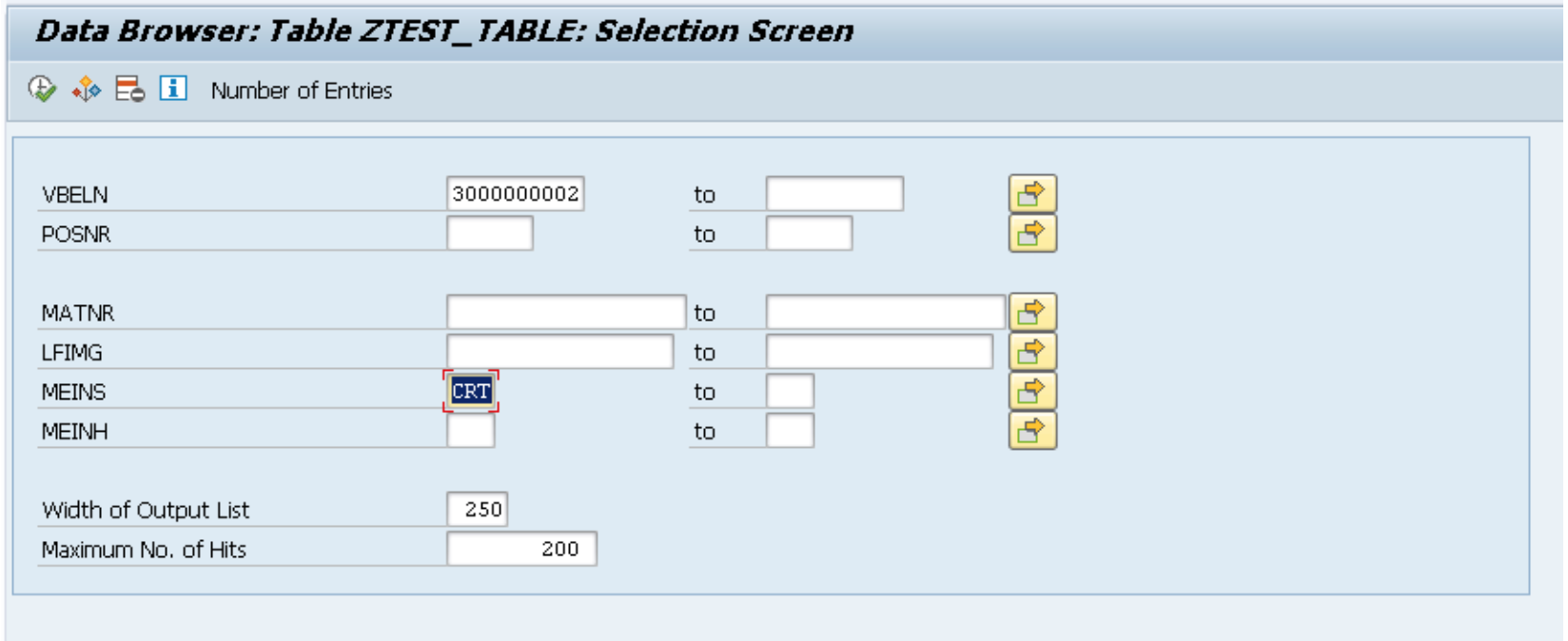

Let’s take another issue that can occur with improper conversions. This can be seen when a developer writes a custom program to mass load data into a table. As an example, I made modifications to my existing program to also store records.

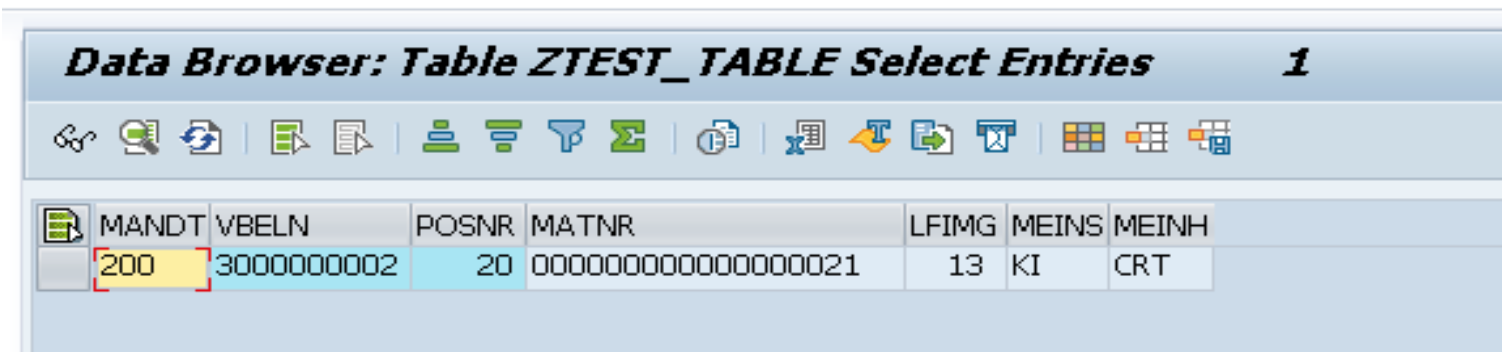

As you can see, when you look at the records SE16N, the new record from the above example appears.

However, when attempting to find the record:

This is caused by storing the improper unit of measure here. The commercial unit was not converted before it was added to the database. So, when running SE16N, when the user enters the unit of measure in the search criteria, SAP automatically converts that into the internal unit of measure. Since the commercial unit is the one that got stored, SAP cannot find a match.

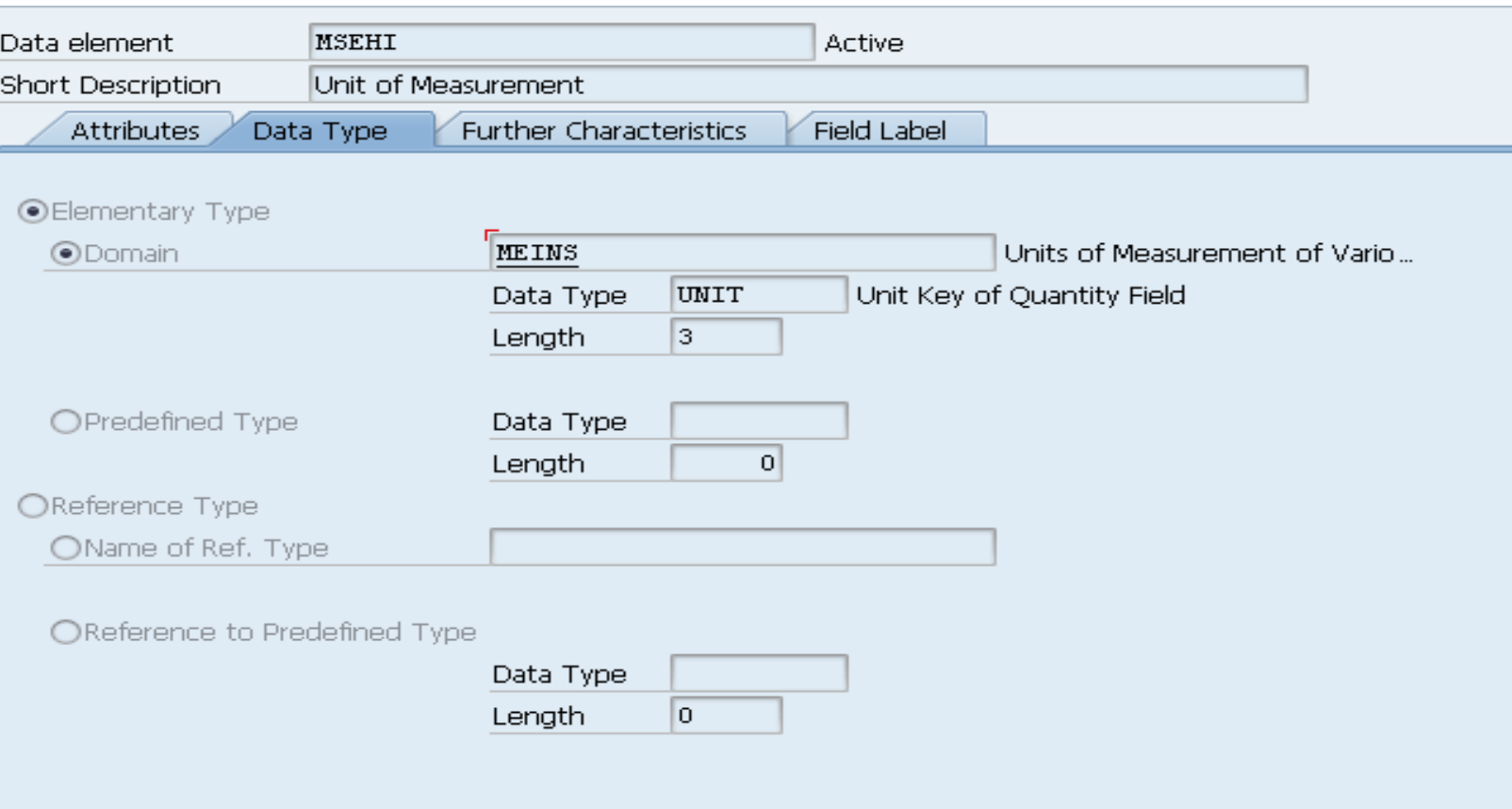

When writing custom programs, a developer must take caution when dealing with units of measure. In many cases, it will be responsibility of the developer to perform the conversion of the units manually, especially when failing to use the correct variable with the conversion exit built in. Fortunately, SAP is good at providing the needed tools to accomplish this. From SE11, the data element for the internal unit of measure(MSEHI) has the domain MEINS.

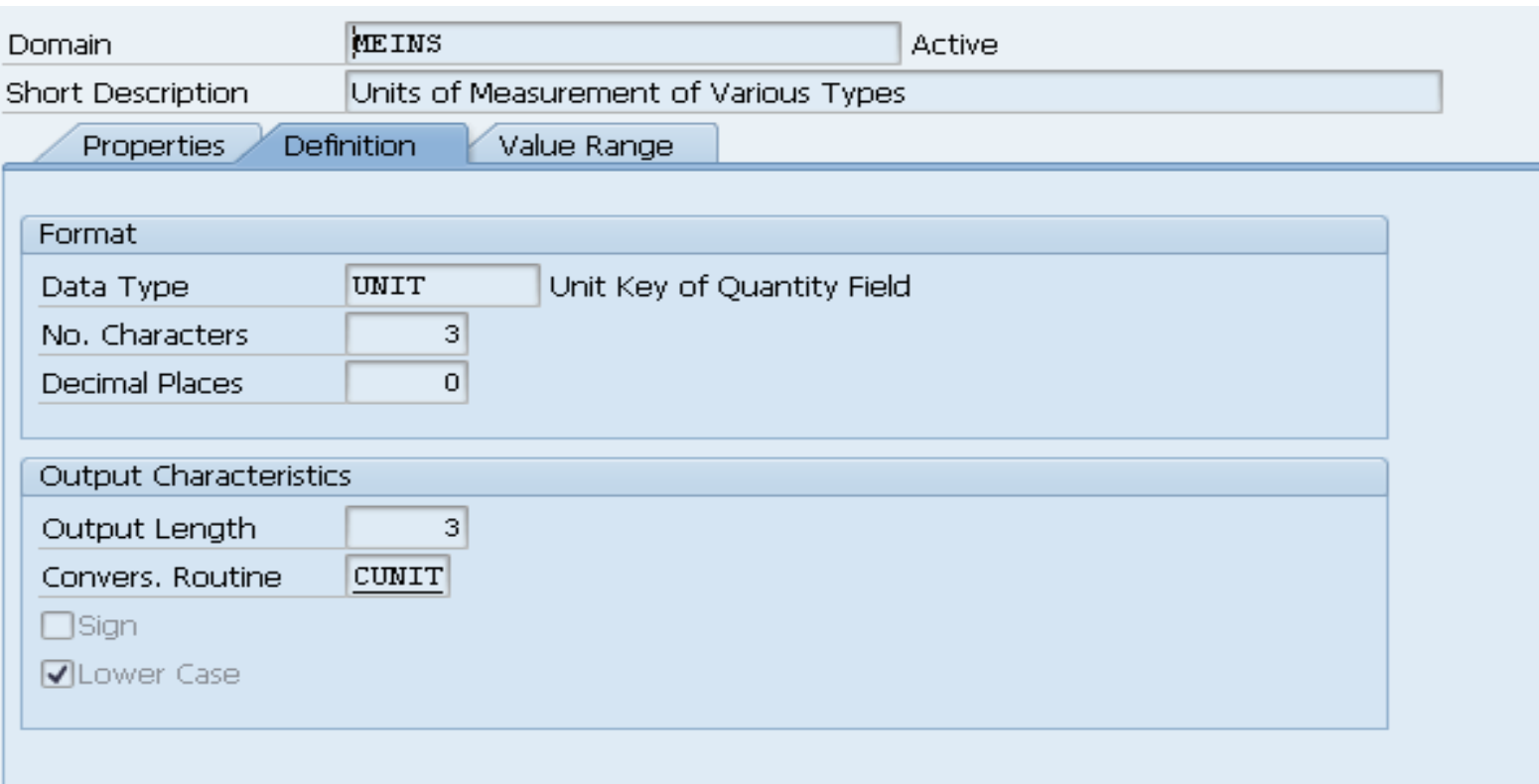

Double clicking the domain name and clicking on the definition tab will show the conversion routing of the data element.

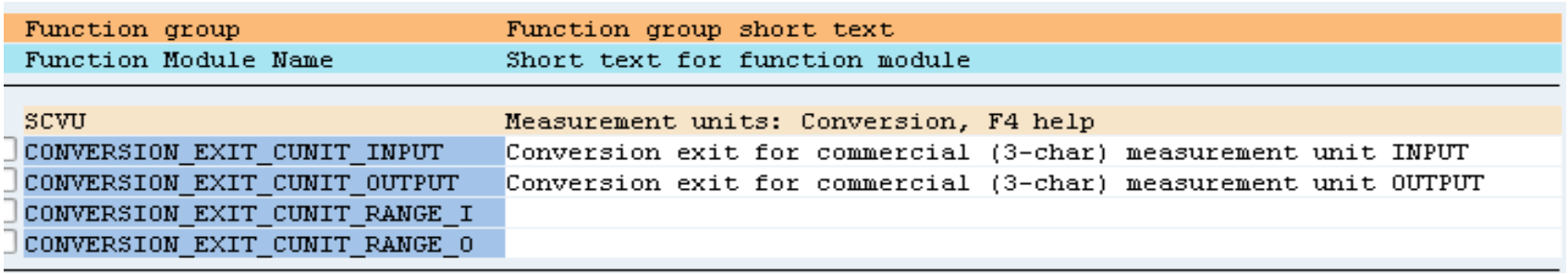

In this example, it is “CUNIT”. Double-clicking the conversion routine name will show the INPUT and OUTPUT conversion routines for this field.

The typical naming convention of a conversion routine is “CONVERSION_EXIT_” followed by the conversion exit name, followed by a final piece to explain the purpose of the function.

For example, CONVERSION_EXIT_CUNIT_OUTPUT is the conversion exit used to convert an internal unit of measure to the commercial unit for user display, while CONVERSION_EXIT_CUNIT_INPUT is the conversion exit used to convert a commercial unit entered by the user to the SAP internal unit of measure when used for storage. As a rule of thumb, OUTPUT is used data is written to a screen, document, etc. While INPUT is used when using that data as input for interacting with SAP table data.

When using the conversion exit for units of measure, one key piece of information is the language. When using the conversion exits, it is best to avoid constants for the language and to use the system variable SY-LANGU. This will always provide the logon language when converting units of measure.

Going back to our example, I’ve added the needed conversion routines to my code. Now, let’s run the report again:

As you can see, both the internal and external units of measure show correctly, and SE16 is able to successfully find the record.

It’s a little confusing at first to distinguish between the internal and external units of measure, but after some time, this will become very clear and will allow for any custom development to handle unit of measure information coming and going.

Finance Differences in SAP S/4HANA

Introduction

This article covers some of the differences between S/4HANA and previous versions of SAP.

Simple Finance was the first part of the Business Suite to be rewritten to run on SAP’s new superfast in-memory HANA database. Simple Logistics followed, and the combined new product, with New GL and New Asset Accounting as prerequisite, became known as S/4HANA.

S/4HANA exists as the S/4HANA Cloud which is a standardized Multi-Tenanted Cloud (i.e. all customers share the same software instance although the data is secure and private). This comes with a mandatory Fiori user interface, quarterly releases, and bespoke programming is not possible as you are sharing your system with others. There is also the On-premise S/4HANA with greater flexibility, freedom to customize as before, and optional Fiori and annual releases.

The exact functionality will vary depending on the release, and this article is mostly based on S/4HANA 1610, which is the October 2016 On-premise release, although some of the functionality below may already be available in the later enhancement packs of ECC6. I have used print screens mainly from the GUI to help users to compare the functionality, but mostly the Fiori apps are quite similar.

A lot of the ECC6 functionality is still available in S/4HANA in the SAP GUI; sometimes transactions are enhanced and easily recognized and both the old and new co-exist (e.g. FAGLL03 and FAGLL03H), and sometimes you are redirected to new functionality automatically (e.g. FK01->BP). It seems where the letter H is added at the end of the transaction, it tends to be a new S/4HANA specific transaction, the letter N has often been added to new transactions anyway, including those introduced with the New GL (and some are already available in later versions of ECC). The letter L at the end of some transactions seems to allow posting to different ledgers e.g. FB01 and FB01L as well as a lot of the new asset transactions, but these are just guidelines not strict rules.

Fiori

Described as the new User-Experience, Fiori replaces most of the SAP GUI transactions, resembling the more user-friendly Smartphone apps instead of the traditional SAP GUI menu structure. Fiori is available on multiple devices i.e. desktops, phones, tablets etc. Informative, interactive apps are available so you can already see the number of outstanding items, or account balances on the face of the Fiori app before you click on it to drilldown further, see Figure 1. Some apps have graphs, calendars (e.g. leave requests), pie charts etc. and the launch pad can contain customized apps and also personas transactions in the same style as the Fiori apps.

Figure 1 Two Fiori Tiles

Ledgers and Currencies

In addition to the normal parallel ledgers which were introduced with the New GL, there are now Extension Ledgers (original called appendix ledgers). The difference is that with an additional parallel ledger, postings are physically made to both the leading ledger and the parallel ledger, with only adjustments made to the parallel ledger, whereas extension ledgers have to be linked to a base ledger and only take delta postings. Therefore, when you run a report for the extension ledger it pulls in both the base ledger and the extension ledger to show you the complete picture. The extension ledgers however cannot be used in asset accounting.

There are now 8 additional freely definable currencies available, although they may not all be available in other modules and a conversion project would be required to ensure historical data is dealt with appropriately.

Data structure

HANA has the power to calculate on the fly, which means that for financial transactions, index tables such as BSIS, BSAS, BSID, BSAD, BSIK, BSAK, BSIM, FAGLBSIS and FAGLBSAS, as well as aggregate tables such as GLT0, GLT3, FAGLFLEXT, KNC1, LFC1, KNC3, LFC3, COSS, COSP are no longer required and have been removed. FAGLFLEXA and some other New GL tables are now obsolete and there are also new customizing tables.

However, if you have your own ABAP reports using these tables, don’t worry as there are now Compatibility views with the same name, which recalculate the same values as the tables would have had, allowing any bespoke programs reading the information to continue to function. There are new tools which you can run prior to migration, which allow you to check which of your bespoke programs are read only and will continue to function and which need rewriting. In any case you may find that some of your bespoke programs are no longer required because that functionality is now available as standard, or that it will be more efficient to rewrite them using the new tables anyway.

Universal journal

This is the name of the enhanced financial document in S/4HANA. A Universal Journal is created whenever anything is posted to Finance from any module and each journal can be displayed as before using the display document transaction FB03. Many of the journal entry, invoice entry and other posting transactions are still available in the SAP GUI, so you can still for example use FB50 or FB50L (by ledger) to post a journal, although the Fiori equivalents are more user-friendly. The Universal Journal is the Single Source of Truth for finance, Controlling and COPA, and includes all the cost objects traditionally found in Controlling such as cost centers, internal orders and WBS elements as well as columns for the standard CO-PA characteristics and up to fifty additional characteristics. See also the next section on merging Finance and Controlling. New reports are available, mainly in Fiori, but the old Controlling reports continue to work (using compatibility views), including those for planning

ACDOCA is the name of the Finance module’s important new S/4HANA table, which is based on the Universal Journal line items, containing all of the financial fields, as well as a lot of information from other modules. Figure 2 shows an extract of the ACDOCA table showing some of the asset and material ledger fields available.

Figure 2 ACDOCA Table Showing Some of the Fields

Single Source of Truth

Finance and Controlling are now merged, getting rid of data redundancies and the need for reconciliations, and making visible the internal CO actual postings in FI as well. The real-time FI-CO integration is also obsolete and Controlling data is stored in the new finance table ACDOCA.

To have only one field available in the Universal Journal for both the GL account and cost element numbers, the cost elements are contained inside the GL account master records. To achieve this, there are now four types of GL account, instead of the previous two, i.e. Balance Sheet and Profit & Loss - see Figure 3.

Figure 3 GL Account Type

If you select Primary or Secondary Costs as the GL account type, then on the Control Data tab you will see Controlling Area settings such as the cost element category (see Figure 4). The dropdown options in Figure 4 are based on choosing primary costs as the GL account type. Categories relating to secondary costs are available if you choose the secondary costs GL account type. Cost element groups are still available.

Figure 4 Cost Element Category

Default account assignments from the cost elements are automatically migrated to the OKB9 configuration transaction and configuring cost object defaults in OKB9 is the only option going forwards.

An additional column appears in Transaction OB52 (opening and closing periods) for postings from Controlling to Finance, (although you still need OKP1 at Controlling Area level), and you have the option of selecting the posting period variant prior to entering the time interval screen.

Account-based profitability analysis must be activated but you can still use costing-based profitability analysis in parallel. Initially realignment was not supported but this has been brought in with release 1610.

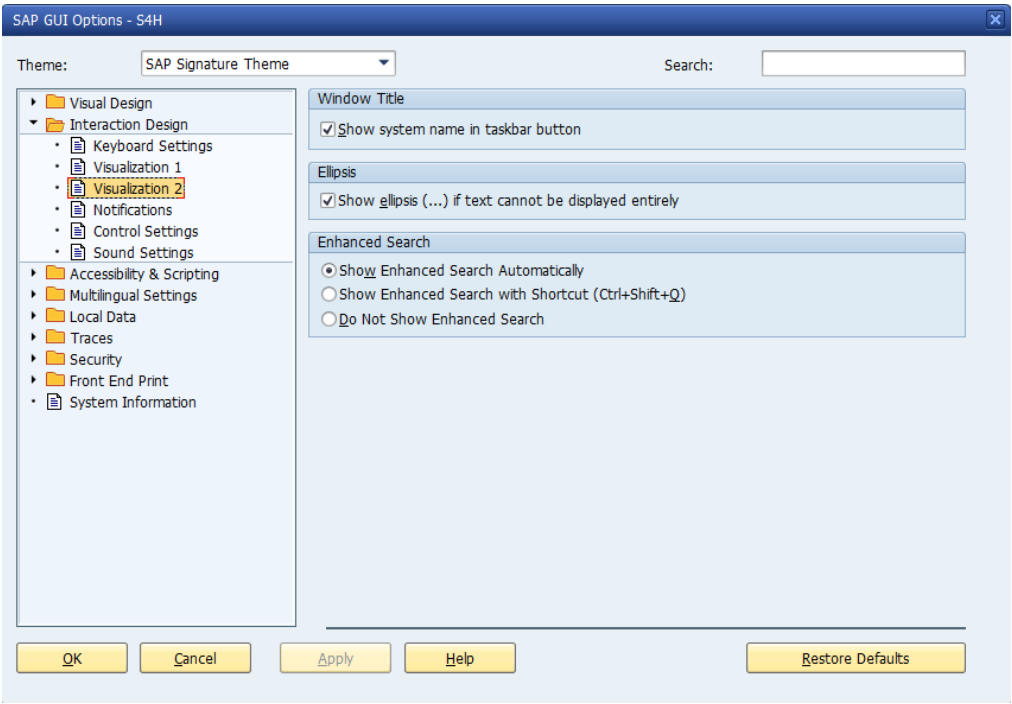

Enhanced Search

If you click on the colored icon at the far right of the top menu bar in the S/4HANA GUI and choose options (see Figure 5), then go to Interaction Design->Visualization 2 you can choose whether to use the enhanced search or not, or only with a keyboard shortcut (Ctrl + Shift + Q), see Figure 6.

Figure 5 GUI Options Menu

Figure 6 Enhanced Search Functionality Settings

The enhanced search functionality can be used in many places, for example in the vendor line item report to find the vendor by name (Figure 7), by vendor number (Figure 8) by postcode, country, search term or anything else available on that specific enhanced search screen. If you search for example for a material (Figure 9) you will see different search options.

Figure 7 Enhanced Search Using Name

Figure 8 Enhanced Search Using Vendor Number

Figure 9 Enhanced Search for Material

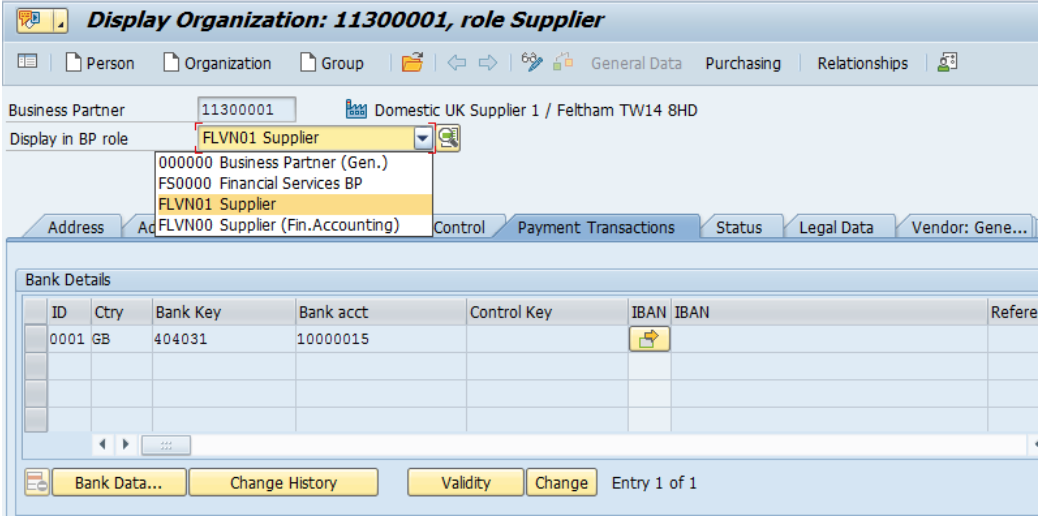

Vendors and Customers

Customers and vendors can only be maintained using the Business Partner functionality (of which there is of course a Fiori equivalent) and if you try to use the old codes e.g. FK01/2/3 or XK01/2/3 to create/amend/display a vendor or FD01/2/3 and XD01/2/3 to create/amend display a customer you will be redirected to transaction BP.

Many of the screens are fairly similar to the old master data transactions, but a lot more data is available and one Business Partner may have roles in MM, SD, and FI. Employees, banks and other contacts can also be set up as Business Partners. Multiple relationships can be specified and new time dependent data is available for e.g. addresses and bank data. See Figure 10 and Figure 11. You will need to migrate your customers and vendors to Business Partners as part of the migration if you are not already using them.

Figure 10 Business Partner Payment Tab

Figure 11 Business Partner Identification Tab

Figure 12 Business Partner Relationship contact example

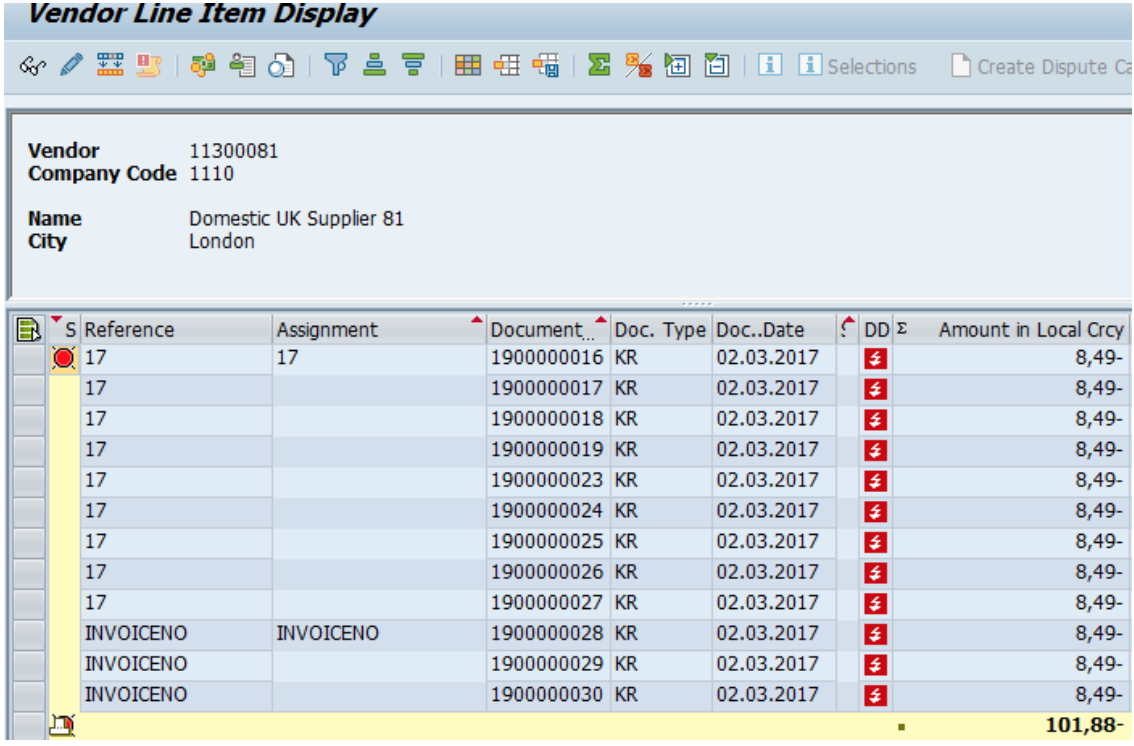

Line Item Reports

The old reports, such as FBL1N, FBL5N and FAGLL03 still exist alongside FBL1H, FBL5H and FAGLL03H which have slightly different screens. The selection screen is quite similar, although note that the additional selections button (the red, green and blue stripy one) now appears halfway down the selection screen instead of at the top and is labelled Restrictions. Once you execute the report however, things look somewhat different and the line items start off summarized by period.

Figure 13 Transaction FBL1H

If you want to see the line items you need to select the lines that you want to see and click on the icon on the right call line item report. This will take you to your normal FBL1N screen. In Figure 14, I chose only the last period, i.e. period 6 in 2017 containing one row, (the cleared payment for the previous period). In Figure 15, I chose period 12, 2017 to show the other display setting in FBL1N. (to toggle between the two, go to Settings-> Switch List in the top menu in the line item display).

Figure 14 Vendor Line Item Display Called from FBL1H

Figure 15 Vendor Line Item Display Called from FBL1H

By clicking on the vendor number in the body of the report, you will be redirected to the vendor master data (held in the Business Partner transaction)

Credit Management

FSCM replaces the previous Accounts Receivable credit management transactions (e.g. F.28/F.31/F.32/F.33/FD32) and the Sales transactions (VKM3/VKM5). If you are not already familiar with FSCM, this already used the Business Partner functionality prior to S/4HANA and has additional functionality, in areas such as Credit Management, Collections Management (including collection worklists), Dispute Management. It also has additional reporting and allows you to import external credit information.

Materials

The Material Ledger is mandatory (although Actual Costing is still optional) and there are also new tables for material documents (MATDOC), a Cost of Goods Sold variance split and no locking of tables. The material number field is extended from 18 to 40 characters and this information is available in the Universal Journal document, and therefore the ACDOCA table for reporting in finance. Note that the extended material functionality can be switched off if for example you have a multi-system landscape.

Global trade Services (GTS)

GTS replaces the foreign trade functionality in Sales and Procurement. This allows the pulling in of data from different systems, and is extensively integrated with SD and MM.

Revenue Recognition

Only the new Revenue Accounting and Reporting, which supports IFRS15, is available in S/4HANA, i.e. the SD Revenue and Recognition is no longer available.

LSMW

The Legacy System Migration Workbench is still available in S/4HANA, but it is not recommended for migrations as it has not been amended for the new data structures, and some functionality is not available e.g. transaction recordings cannot be made with the Fiori transactions.

The Maintenance Planner tool has to be used for a system conversion, which among other things, checks add-ons, active business functions and industry solutions to ensure that they can be converted.

Central Finance

Central Finance is a new concept introduced with S/4HANA. It allows users with a large and distributed landscape to replicate both SAP and non-SAP finance data real-time to a central S/4HANA system, but still allowing drilldown to the original document in the SAP systems.

Cash Management

There is a suite of programs, Cash Operations, Bank Account Management (BAM) and Liquidity Management that replace the classic cash and liquidity management, and you can centrally manage the actual and forecast cash positions from SAP and non-SAP systems by using the One Exposure operations Hub. Transactions such as FF7A and FF7B (cash management and liquidity forecast) are now Fiori apps.

House banks and house bank accounts, which are now master data, can be managed by users in Fiori, along with banks hierarchies or groupings, overdraft limits, signatories and approvals flows and additional reporting such as the foreign bank account report, helps compliancy. The hierarchy uses the bank business partner role

Bank accounts can also be downloaded and uploaded to and from Excel, for reporting, migrations and mass changes. They are created in the productive system, but still need to be replicated to the development and quality assurance systems etc. as configuration for payments and bank statements still needs to be made in the development system and moved through quality to production as usual.

If you don’t want to implement the full Bank Account Management (BAM), then Basic Cash management is also available, previously known as BAM Lite.

Other Fiori apps available include for cash operations include the Incoming bank statements monitor, cash payments and approvals, cash position reports, transfers, cash pooling.

Figure 22 Examples of a Few Bank Management Apps in Fiori

FI12_HBANK is the SAP GUI transaction for the user that replaces the House Bank icon in the customizing transaction FBZP, (see Figure 23), although you will find more functionality in the Fiori App such as the hierarchies and groupings. After entering the company code on the first screen you can display, amend or create new house banks.

Figure 23FI12_HBANK - House Bank Transaction in SAP GUI

New Asset Accounting

Depreciation Areas - You still have the choice of using the parallel ledgers brought in by the New GL or accounting for different accounting principles using a different range of GL accounts. However, even if you use different accounts for the different accounting principles, you still need to set them up in asset accounting as dummy ledgers. You no longer need to set up delta depreciation areas where you have additional accounting principles, but you do need to have a one to one match for each currency and ledger in Finance with a depreciation area in Asset Accounting.

The depreciation areas are now equal (i.e. depreciation area 1 does not have to be the leading ledger) and transaction ASKB, (post additional depreciation areas periodically to finance), has been removed because you can post all depreciation areas to Finance in real-time if required. Because all the postings are real-time, you can navigate and drill down to most of the financial documents not just those in depreciation area 1.

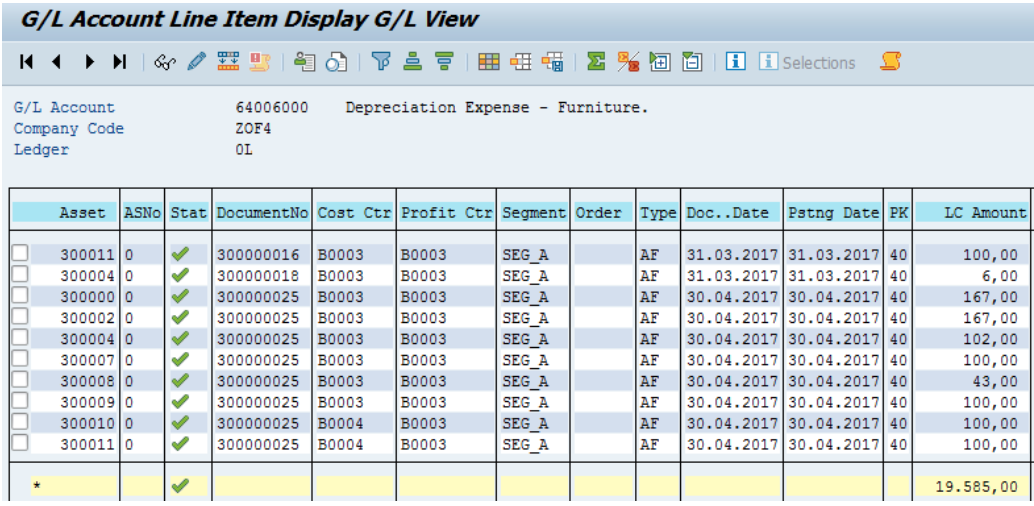

Postings – As with finance, a lot of the tables are now redundant and a lot of the asset information comes across via the Universal Journal in table ACDOCA. The asset balance sheet accounts are now all reconciliation accounts – even those in the additional depreciation areas, which prevents manual postings that are not updating the assets. The depreciation run posting has been improved and the depreciation journal contains asset information at line item detail so in the GL line item report you can see the amounts by asset, see Figure 16

Figure 16 Depreciation Account in GL Account Line Item Display

You can also drilldown to the asset accounting from the finance document (click on asset accounting icon in Figure 17) to see the postings by ledger group.

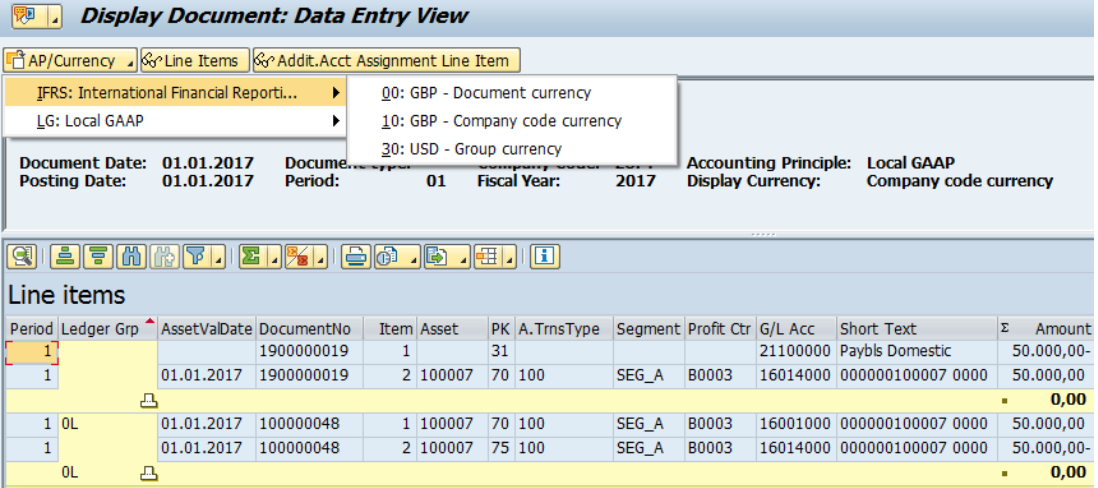

Figure 17 Finance Document for Asset Acquisition

In Figure 18, you can see the Technical Clearing account functionality. This is required to post the other depreciation areas in real-time, whilst allowing the flexibility to post each asset differently in each ledger. Some accounts, for example vendors, customers, GRIR account and tax accounts cannot be posted to unilaterally i.e. in one ledger and not others. Therefore, the acquisition or retirement posting is split into at least two documents. The first is called the operational posting and has a blank ledger group i.e. it posts equally to all ledgers.

The posting for an acquisition is credit vendor and debit technical clearing account. The second, valuating posting, then posts between the technical clearing account and the asset with a separate document for each ledger. To get to the posting for the additional ledgers and currencies, you have to click on the A/P Currency icon (which stands for Accounting Principle/Currency) and you can see the document in Figure 22 shares the same operational posting with document 1900000019 but has a different valuating posting with document 7000000073 instead of 100000048 which was the document number for the leading ledger.

Figure 18 Figure 14 Drilldown to Ledger Postings by Asset

Figure 19 Asset Acquisition, Parallel Ledger Posting

Accounting Principle and Depreciation Area are new fields now available in many new transactions (e.g. ABZOL instead of ABZO, or ABUML instead of ABUM and so on), so there is no longer a need for depreciation area specific transaction types.

Settlement rules can also be ledger specific if required, see example in Figure 20

Figure 20 Ledger Specific Settlement Rules

Year-End – this is now carried forward as part of the finance transaction FAGLGVTR, in other words both the general ledger and assets are carried forward together

Statistical postings – instead of statistical cost elements with cost category 90 there is now a special field in the GL account master record only in fixed asset and material reconciliation accounts called Apply Acct Assignments Statistically in Fixed Asset Acct/Material Acct.

Figure 21 Asset Statistical Account Assignment

I have written more about New Asset Accounting in my latest E-Bite Introducing New Asset Accounting in SAP S/4HANA – you can find out more at https://goo.gl/qIbdQZ which is a short cut to the SAP Press site. This book covers how new asset accounting works in S/4HANA and is aimed at users who are new to SAP as well as those migrating from earlier versions of SAP.

Ask a Fixer: What You Should Know About Profitability Analysis with S/4 HANA Finance

EXCLUSIVELY FOR ASUG MEMBERS!

Start: Thursday July 13th, 2017 12:00 PM (CT), 1:00 PM (ET), 11:00 AM (MT), 10:00 AM (PT)

End: Thursday July 13, 2017 1:00 PM (CT), 2:00 PM (ET), 12:00 PM (MT), 11:00 AM (PT)

There are several changes that have been made with S/4 HANA Finance. One of the major ones is with the integration of Profitability Analysis (CO-PA) with the General Ledger, which provides new data structures and enhanced functionalities that enable flexible, multidimensional reporting, and seamless reconciliation.

Attend this webcast and live Q&A with ERPfixers experts and Financials Expert authors, Ajay Maheshwari and Kavita Agarwal to learn more about the following:

How Account-Based CO-PA is integrated with the Universal Journal

The considerations to be taken into account when converting from Account-Based to Costing-Based CO-PA

How to perform realtime derivation in CO-PA and reduce the need for month-end settlements

The setup needed to break cost of goods sold into cost components using Account-based CO-PA

How CO-PA allocations work with the Universal Journal

Speakers:

Ajay Maheshwari, SAP FI/CO and SAP S4/HANA Solution Architect

Kavita Agarwal, SAP FI/CO and SAP S4/HANA Solution Architect

Amsterdam Financials 2017

ERPfixers is honored to announce that Paul Ovigele, Founder of ERPfixers, will present at the Financials 2017 Conference. The definitive conference for organizations using SAP solutions for finance to drive accounting, controlling, planning, and reporting excellence. Join us!

Our Session(s):

Tackle your most common financial pain points using existing and new SAP functionality

Wednesday, 14 June, 2017 16:30 - 17:30 G102

Speaker: Paul Ovigele, ERPfixers Founder

Learn the how-tos, gotchas, and workarounds you need to know to conquer the most common challenges associated with financial and managerial accounting, including the reconciliation of CO-PA with SAP General Ledger, and using cost component split functionality. Get expert advice to:

- Deal with the timing difference of goods issues between FI and CO-PA

- Learn the changes to CO-PA with SAP S/4HANA Finance

- Ensure that credit and debit memos, which relate to price alone, do not update the Cost of Goods Sold (COGS) value field in CO-PA

- Handle the posting of discount conditions to CO-PA

- Configure the cost component split using SAP S/4HANA Finance

- View cost of sales postings in the SAP General Ledger by cost component

Ask the Experts FIN and GRC

Wednesday, 14 June, 2017 17:45 - 18:30 Exhibition Hall

Speaker: Paul Ovigele, ERPfixers Founder

Sit down with leading experts who manage, deploy, and support SAP environments to get detailed answers to your toughest questions. Draw on the real-world experiences from some of the industry’s top technologists and tap into one-on-one time with experts and walk away with detailed answers to the questions that matter to you most.

SAP Material Ledger: Guidelines and Benefits

Thursday, 15 June, 2017 10:45 - 11:45 G105

Speaker: Paul Ovigele, ERPfixers Founder

Take a comprehensive look at material ledger, including what it does, when you should use it, and how to interpret its results. Delegates will:

- Discover how to properly analyse material ledger information using the Material Price Analysis report

- Find out how long the typical material ledger implementation should take

- Hear how certain companies have used material ledger to solve their transfer pricing and intercompany elimination requirements using standard SAP functionality

- Walk away with a clear understanding of how material ledger fits in with SAP S/4HANA Finance functionality

TWEET us at #Financials2017!

@ERPfixers #ERPFixers

Measuring and Managing Customer Profitability

You may have interest in this article I authored titled “Measuring and Managing Customer Profitability” for the Strategic Finance magazine published by the Institute of Management Accountants. Its message is that customers are the source of financial value to increase shareholder and owners’ value. But today customers view suppliers’ products and service-lines as commodities. Therefore suppliers must provide differentiated services to different customer segments. The sales volume of high demanding customers is not proportional to their profit level because they cause extra expenses from their suppliers. (I wrote the article related to my part time role as the IMA Executive in Residence now in my 4th year term. The www.imanet.org has 85,000 members in 140 countries.) Here is the link to directly download the article as a pdf file:

“Measuring and Managing Customer Profitability”; IMA Strategic Finance; February 2015.

I have also recorded two courses on this topic with Michael Management Corporation:

My first course is MMC – IC0541: Analytics Based Enterprise Performance Management

Second course MMC – IC0593: Measuring and Managing Customer Profitability

Third course MMC – IC0599: Driver-based Planning, Budgeting and Forecasting

3 Quality Management (QM) How-To's

Learn how to do the following:

Automatic Usage Decision and follow up actions

Mass Result recording and Mass UD

Sampling procedure settings at plant level

1. Automatic UD and Follow Up Actions

Most of the time, Quality department would like to perform automatic usage decision and automatic stock movements based on recorded results. It is a key area which provides customer satisfaction, when they perform their daily work, whereas system provides assurance of validation and follow on activities.

To enable the same, SAP has provided many options, which provides a lot of value addition when used properly.

Automatic Usage Decision options and follow up actions

If the results recorded are not rejected, free of defects and all required characteristics have been confirmed, then SAP allows performing Auto UD.

Many times, there will be interfaces defined between LIMS / Quality lab systems / Level-II systems with SAP, to record the results. The quality management team would like to enter the results as and when operations are performed in the lab system and would like to fetch reports / certificates from SAP when the information is transferred. When the data is transferred and results are recorded, business will be more focused on spending time effectively, where issues are identified. To enable a smart management, the lots should be made Auto UD and auto stock posting, if all results are okay. In case of any issue, the lot should be open and user should action accordingly.

In SAP, the inspection type has “Automatic UD” option, followed by Plant level settings to define “wait time” if any. Once these are selected, QA17 allows creating a job that performs Auto UD, if above conditions are met.

In qcc0 settings for selected set, you can define the follow up actions and “Posting proposal UD”. The posting proposal “To unrestricted Use” can be set at this level for 100% acceptance level, to ensure that stock is moved to unrestricted use if all desired conditions are met. This will provide a lot of value addition to business, as Lab in-charge or QC Manager only need to focus on real issues, rather than going through each lot one-by-one.

Automatic UD at Client level

QCC0-> basic settings -> Maintain Settings at Client Level -> Further settings

Quality inspection Automatic UD can be activated at this setting, followed by event type linkage activation of event RESULTRECORDED under SWETYPV-> Business function BUS2045.

However, the client level settings are usually performed during initial phases of the project.

2. Mass Result Recording and Mass UD

There are cases when business requires performing RR and UD in mass. The regular options of QE01 / QA32 allow individual lot level activities. To avoid customizations on this area, it is possible to perform the below

QE71 - For Inspection Points

QE72 - For All Inspection Lots

QE73 - For Master Inspection Characteristic

For example, QE73 allows to enter results on tabular form, for a particular MIC Code.

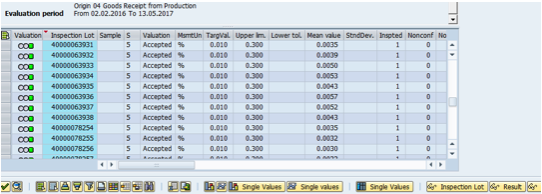

The result history option displays the history of results recorded for the MIC code between a desired timeframe, for reference:

Mass UD is possible using Jobs, planned through QA17 or manually using QA40. It is also possible to perform Collective Usage decision using QA16.

This is especially useful during order completion / month closing activities, to ensure there are no open lots. It is also helpful to use Transactions QVM1 and QVM3 to know the open lots.

3. Sampling Procedure Settings at Plant Level

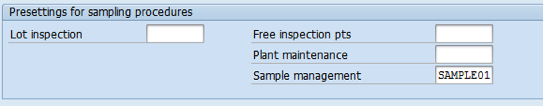

Pre-settings for sampling procedures are available at QCC0->Basic Settings -> Plant level settings-> Inspection lot creation.

To explain the purpose, consider the case where inspection at Physical samples needs to be carried out. It is mandatory to define sampling procedure and assign the same to all inspection characteristics when you define inspection plan for the same.

However, the sampling procedure may be relevant for few MICs in real business scenarios, whereas other MICs do not have such requirement. If the sampling procedure is set at plant level configuration as shown below, the sampling procedure is automatically copied, if there are characteristics to which no sampling procedure has been assigned in the task list or material specification.

Q&A: Simple BI With Business Objects Cloud

The following is a recording of a live webcast hosted by ASUG, with ERPfixers expert Fixer Ricardo Sada. You will find the following answers and more in the video:

What kind of SQL databases are supported for connections?

How does the ERP connection work?

Dive in to what a Live Connection is please.

Does BO Cloud work in mobile devices?

Is it slow to access sql server from SAP cloud to on premise (through firewall) and live data/connection?

How does this compare to Power BI with respect to getting 3rd party developed visualizations?

How is this different from SAP HANA Cloud?

All on premise data from my company need to import/upload to SAP cloud in order to use (live connection to on premise database or extract from it)?

First Steps in SAP Fiori

Excerpt from First Steps in SAP® Fiori

by: Anurag Barua

Chapter 4 SAP Fiori: An Overview

A question that many of my customers ask is, “What is SAP Fiori all about?” It’s a question that has a significantly long answer because SAP Fiori is not just one thing but rather a convergence of many things. Quite simply, it is SAP’s truly new user experience, or for those of you with a technical mindset, it is SAP’s new user interface. SAP Fiori marks the end of the era of the traditional gray screens of the flagship SAP GUI, which has existed for over two decades. SAP GUI has been a constant scourge for SAP users worldwide because of the over-abundance of fields and tabs that users have to either enter data in or click through and because of its distinct lack of visual appeal. For those of you interested in statistics, there are over 300,000 individual SAP screens that form the conduit for transactional processing. This is not a trivial number and what bewilders SAP users even today, is that a lot of these screens contain fields that are rarely used and every basic transaction has multiple screens that a user may have to scroll through.

SAP Fiori provides users with a standardized (tile-based) look and feel that is intuitive, visual, and offers fields that are displayed based on the user’s roles and authorizations.

At the heart of SAP Fiori is the increasing number of out-of- the-box apps (applications) that SAP provides which correspond to the whole gamut of standard business processes such as order entry (purchase or sales), leave request approval, etc. Currently, there are almost 500 apps available free of charge and if the investment into SAP Fiori is any indication, this number will continue to increase. If the SAP infrastructure prerequisites are met (I will discuss these later), you should be able to be up and running with any such app in a matter of a few hours. When I started my own SAP Fiori odyssey a couple of years ago, it took me approximately six hours to get a standard cost center app up and running. Disclaimer: All configuration on the infrastructure side had already been performed by the Basis/NetWeaver administrator and I was able to draw heavily on my years of SAP experience.

SAP Fiori represents a shift from transaction code-based interaction to interaction that is driven by business processes and the users’ roles and responsibilities in an organization and as maintained in the SAP security framework. The interaction is heavily influenced by the seismic shift that has taken place in the consumer marketplace, where business is increasingly transacted on mobile devices via simple apps. SAP Fiori leverages this concept to provide the same end user experience that eschews exposing the complexity of the solution and provides users with an engaging experience. It is based on the theory of “build once, run everywhere”. Therefore, with SAP Fiori, your app will run on your desktop as well as your mobile device and will look and feel exactly the same on both: you do not have to create a separate desktop version of your app and a separate one for your mobile device.

As the years have gone by, SAP’s advertising campaigns bear testimony to how the focus has shifted from highlighting its all-encompassing and integrated nature to a simplified, user-driven software suite. The journey from The Best Run Businesses Run SAP to Run Simple has seen SAP go through many ups and downs and

detours, has seen SAP go through many ups and downs and detours, including multiple acquisitions and strategy changes, as it has evolved from an introverted German software maker to a global innovation factory that provides speedy solutions with a high business ROI. And one of the primary lessons that SAP has learned well is that no matter how wonderfully efficient the software engineering is, it is ultimately the user experience that counts.

SAP Fiori apps have been designed using certain platform-agnostic design tools such as HTML5, JavaScript, and CSS. This combination of tools has been wrapped into something called SAP UI5 but I will come back to this a little later. As a result, SAP Fiori apps can be rendered on all kinds of mobile devices without the need for any software magic such as creating wrappers to ensure compatibility. Furthermore, this framework also provides users with a convenient means to enhance existing apps and incorporate users’ business needs.

SAP Fiori and NetWeaver security: A question that is often asked is whether SAP Fiori leverages the SAP NetWeaver security framework or whether you have to design security separately for SAP Fiori. The good news is that SAP Fiori allows you to leverage your existing NetWeaver security model. In fact, when you configure any app, the visibility and access are determined by the roles and authorizations that particular user is assigned to.

Keep reading in First Steps in SAP Fiori by Anurag Barua [https://espresso-tutorials.com/Programming_0126.php].

Are you wondering what SAP Fiori is all about? Dive into SAP’s new user interface and gain an understanding of core SAP Fiori concepts and get quickly up to speed SAP Fiori functionality, architecture, prerequisites, and technical components. Walk through key configuration and get examples of what has gone well (and not so well) on real SAP Fiori implementation projects. Take a technical deep dive into the types of Fiori apps including transactional apps, analytics apps, and fact sheets and walk through custom development and enhancements. By using practical examples, tips, and screenshots, the author brings technical and non-technical readers alike up to speed on SAP Fiori.

SAP Fiori fundamentals and core components

Instructions on how to create and enhance an SAP Fiori app

Installation and configuration best practices

Similarities and differences between SAP Fiori and Screen Personas