Here are some things to consider when assessing a move to S/4 HANA Finance:

HANA & S/4 HANA

HANA is the superfast powerful “in-memory” database. It organizes data differently to reduce complexity, it is faster to access, indexing, aggregating not required etc. Instead of holding totals in tables, totals are calculated on the fly (a phrase you will hear a lot – meaning recalculated as you go).

Considerations/Questions:

Some customizing will still work as there will be “views” with the same name as the obsolete tables (recreated from the new table for this purpose). Your bespoke program can read from these views but if your bespoke programs were writing to tables, you cannot write to the views

You should be told about various tools to check your bespoke customizing well before any migration. In any case, it is a good idea to review as you may now be able to replace some programs with standard functionality

You may find a separate charge for the database, in addition to the S/4 HANA and the landscape

S/4 HANA is the SAP Business Suite that is built and optimized to run (only) on the HANA database.

You will see two different types or editions of S/4 HANA (i.e. the business suite “software”) but the combination with different landscape options can be confusing.

The names of the two different S/4 HANA editions are:

SAP S/4 HANA Cloud (although a number of different versions exist) with quarterly releases

SAP S/4 HANA on-premise – each release is named after the year and month – we have had 1503 (Simple Finance only), 1511 and 1610 releases (1610 the current one was released on Oct 2016 next will be 1709 i.e. Sept 2017)

The first is sold as a service and is available on a multi-tenanted public cloud (i.e. your data is secure, but you share the programs with other customers - simplified, standardized, almost no custom programming) whereas the on-premise version is available how you want it, on third party or your servers/cloud, with custom programming allowed (and when we did it more complex to license and buy/hire the different pieces)

(Be careful because the first is called The Cloud edition, and usually what people mean when they say Cloud, but you can also have your on-premise edition in a cloud)

Considerations/Questions:

If you are using an Industry solution check whether it is compatible specifically with edition that you are going with

Check any restrictions - e.g. AFS with 1511 edition did not use BP (Business Partners) although BP was mandatory for the standard solution

Free trials are available but careful that you understand which edition you are trialing

Check paths (if on e.g. 4.6 you may have to migrate first to higher version, then convert to S/4 HANA if not a new implementation)

Landscape

Public Cloud

Multi-tenant, scalable, operated by service provider and not customer, and lot of simplification, pre-configuration and Fiori front end. Different versions such Enterprise Management Cloud (the main Business programs), Finance Cloud, Professional Services Cloud, Hybris Marketing Cloud and Manufacturing Cloud.

Effectively the Public Cloud has one set of programs that you are sharing with other customers. It should be very secure but it does mean that very little, if any bespoke work can be carried out.

Very different concept to standard SAP. You have access to a reduced version of the SPRO/IMG (the configuration menu) and you cannot write your own ABAP programs. You have quarterly updates and you do not have a choice about implementing them. In the past, you may have had a Development system for configuring and unit testing, a Quality/Testing system and perhaps a Training system as well as the final Production client, the public cloud structure is very different (you usually have production and one other)

Generally sold as Opex rather than Capex (operating rather than capital costs) or subscription based for the combination of software and hardware. Self-service configuration allows business users more access to set up e.g. of organizational structure, house banks

Considerations/ Questions:

Security

Check into different versions (mentioned above) there seem to be a lot more available now

Licensing (subscription – user/revenue based)

Backups

Upgrades

OSS notes

If system crashes – time to reboot and get data back into memory – how the data is backed up while you work and how much time you might lose (should be minimal but they should be able to explain this)

Service level agreements, incident support, monitoring, what is included

Check how many systems involved (usually production plus one other).

Check – but I think it uses only Fiori will you have enough Fiori transactions that you need as not all GUI transactions may be available in Fiori

HEC (HANA Enterprise Cloud)

Be careful when people mention Cloud as they usually mean public cloud. HEC is often referred to as on-premise rather than cloud as this is the edition of S/4 HANA that is used with it.

HEC is owned by customer or Third Party, but still scalable. One upgrade/release per year. Here you are the only one on the system (regardless of whether it is Cloud or not) so you are free to choose when the upgrades happen, what bespoke programming/customizing you want to carry out etc. Upgrade is an IT project (as opposed to private cloud upgrades which are done automatically by SAP)

Considerations/Questions:

Hybrid

Mix of two, you may have some systems in the cloud and some not.

Implementation

3 Options:

System Conversion - On-Premise Edition only

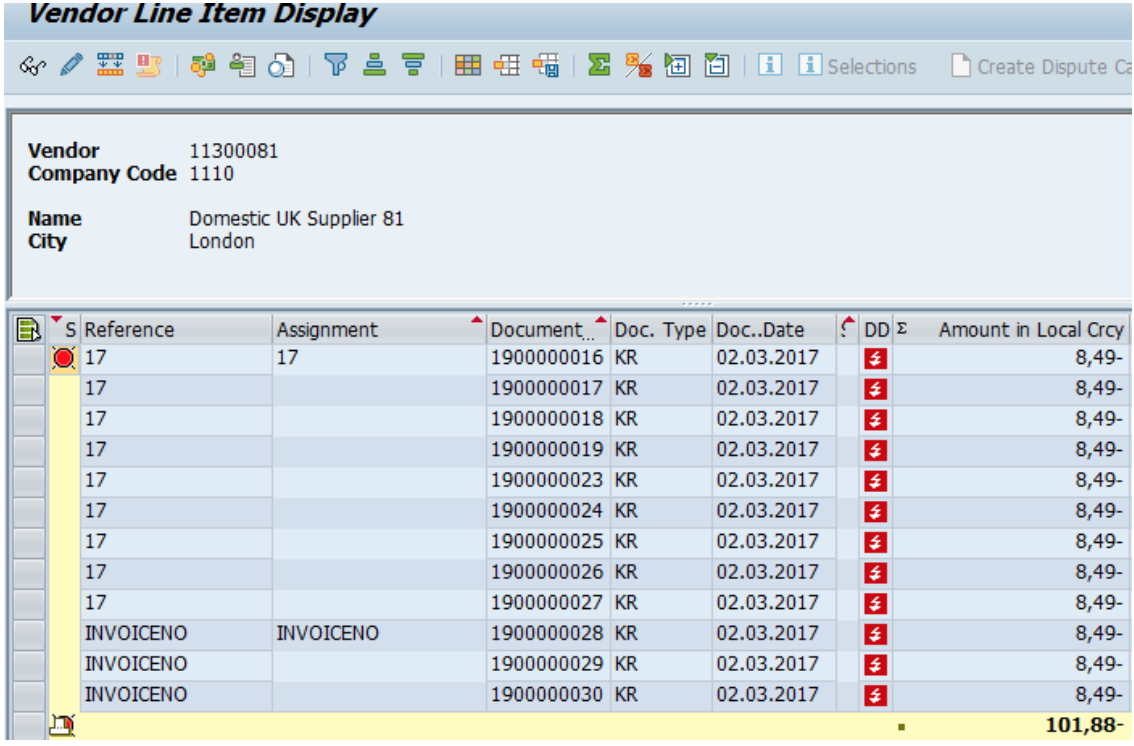

Data is directly converted with history in the existing system (but not necessarily all history–e.g. you could take last 5 years’ open items). Figures have been quoted to me of downtime of one weekend for the physical conversion itself, but obviously depends how much data and the complexity and what other changes are taking place and you would.

You would still need many months testing and full project team in place, especially if you have many interfaces. It also assumes that you make copy your productive system to a sandbox to do the first test run, which will give you an indication. Bear in mind you will also have to convert all your development, quality, training etc. Systems. Can’t use with public Cloud

Considerations/Questions:

Are you migrating to New GL or already on it? This has major effect on timing as New GL has to be at yearend

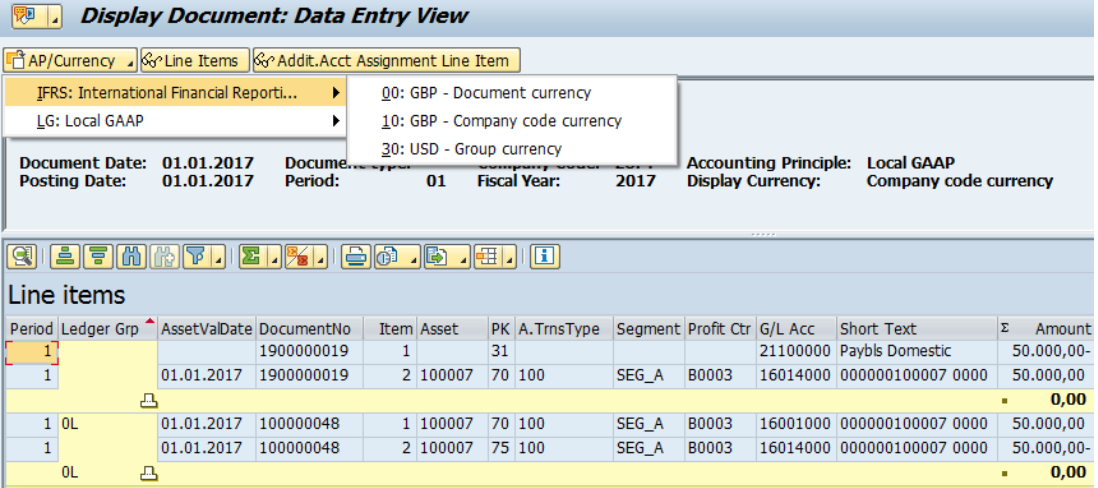

Are you introducing Parallel ledgers with new GL. Discuss with SAP whether better to migrate to new GL and parallel ledgers before implementation (only since the 1610 release can you add parallel ledgers after migration but not sure if you can add them during

Document splitting – this cannot be added (in 1610) after migration so you may have to go to new GL before the migration to S/4 HANA

Integration to other systems - depending what you have been using in the past there may now be more efficient ways of interfacing to other systems – this should be looked into

Have to convert whole system at once – cannot move in stages (e.g. once company code at a time)

Check steps – usually install HANA database before conversion, some config tasks

maintenance planner to run through tasks and timing

Greenfield Implementation

Worth considering if on SAP for years. you can use the move to S/4 HANA to move to Best Practices, re-engineer business processes and get rid of a lot of obsolete or no longer necessary bespoke work.

Considerations/Questions:

Central Finance/Landscape Transformation

To consolidate a lot of diverse systems very quickly, you basically map your finance data from all your SAP and non-SAP data to a Central Finance S/4 HANA system. The data is reposted, but if coming from an SAP system you can drilldown to the original data and you get all the advantages of the speed and consolidation upfront and can migrate the individual systems when you are ready.

Considerations/Questions:

this is not a migration of historic data

still a great deal of mapping to do if individual companies on different systems, chart of accounts etc.

was not a separate cost for the Central Finance itself – just the way it is configured but you may need tools for the mapping

Storage

Data aging strategies (i.e. which data is held in memory, which “nearby” and any archived on different system etc. – data used more frequently should in “hot storage” and “warm storage”.

Fiori

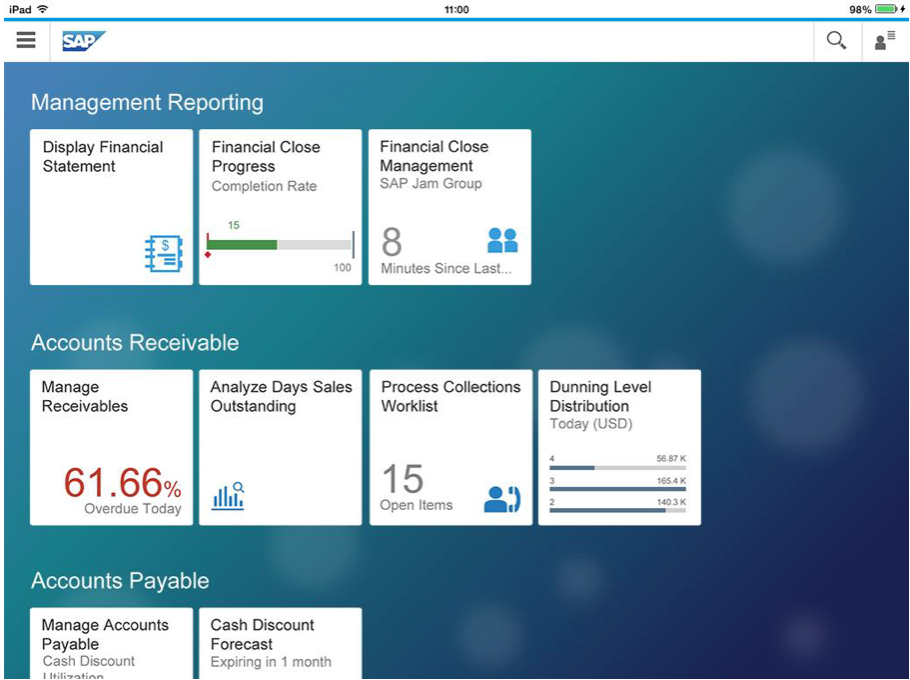

Described as “user experience”, consists of Apps or Tiles (rather like a smartphone than menu path/transaction codes). Includes interactive apps (see figure below) where key information is available on tile itself. Uses Launchpad for home page. Available for multiple devices, desktops, tablets/phones. Based on user roles, so smaller transactions tailored for specific role (not necessarily every field available for every user)

Worth considering and mandatory for Public Cloud version.

Considerations/Questions:

Check in-house knowledge required for Fiori and U5 stuff

Check whether Fiori is mandatory (generally shouldn’t be for on-premise), but SAP will try to sell it

Are the transactions you need covered by Fiori (most standard ones should be)

Worth looking at what is available on Fiori that is not on the SAP GUI

Check what transactions are available for mobile devise (I presume e.g. approving a PO might be but not sure if everything is)

Should be trial versions available

If using personas – check how fits in with Fiori (should be seamless but you will need to know how)

I believe the GR/IR cockpit is neither a GUI transaction nor a Fiori App as it is not in my 1610 S/4 HANA version nor the Fiori Apps I have access to, nor the Fiori catalogue

If the GR/IR cockpit is indeed separate functionality/program; check whether separate licensing/cost is involved and what other functionality is included.

Not all of the thousands of SAP ECC transaction codes were available on Fiori – check whether you still need GUI access