Many users wonder how SAP calculates the Net Present Value or Mark-to-market figures in transaction JBRX. This post seeks to help users gain an understanding and interpret the results that are generated when one executes the transaction.

Background

An investment transaction generates a series of future cash-flows and the Net Present Value (NPV) is the present value of future cash-flows.

Example

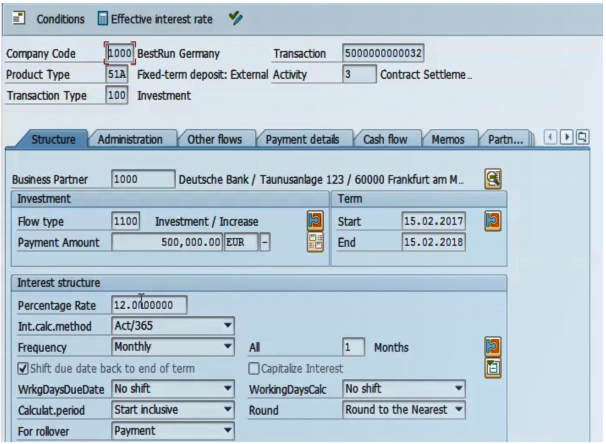

Invest in a €500000 Fixed Term Deposit for one year at a monthly interest rate of 12%.

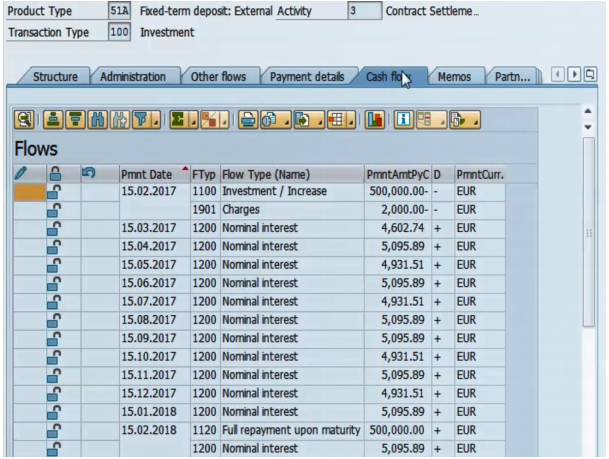

Cash-flows are calculated as below:

To calculate the NPV use transaction code JBRX.

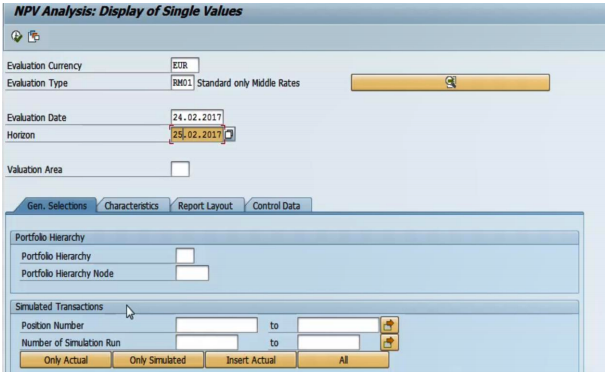

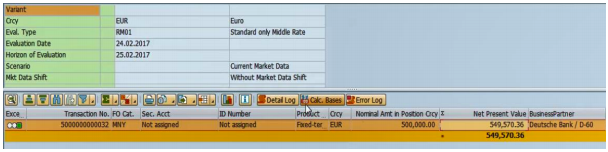

On the selection screen, enter the following information:

Evaluation Currency

Evaluation Type- This carries the relevant evaluation parameters that will be used in the calculation of the NPV.

Evaluation Date- This is the date that determines the market data that will be used in the NPV calculation.

Horizon- This is a future date on which future cash-flows are discounted. The horizon date must be greater than the evaluation date.

You can also select to run the NPV analysis using simulated transactions and you can limit the NPV Analysis bases on different characteristics, for example transaction number.

Once you are happy with your selection criteria, you click Execute.

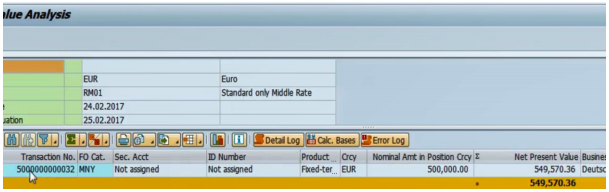

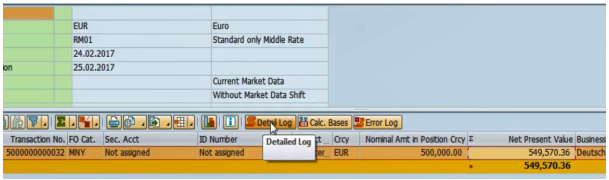

The system now displays the transaction which we entered in the selection characteristics and both the Nominal amount and the NPV amount are displayed as below:

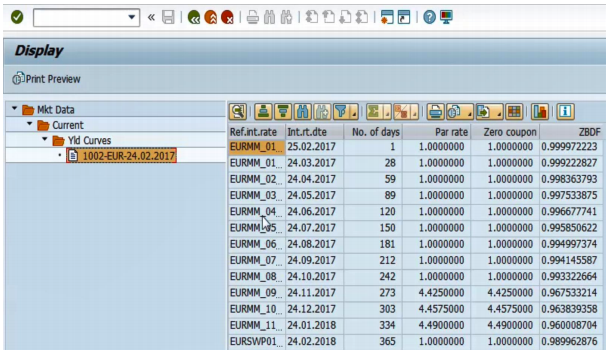

Highlight the transaction and click on Detail log to view the yield curves that have been used in the NPV calculation. The Yield Curve Framework is used to maintain reference interest rates and enter their values. On the basis of the reference interest rates, you can create yield curves to help you determine mark-to-market net present values with the price calculator.

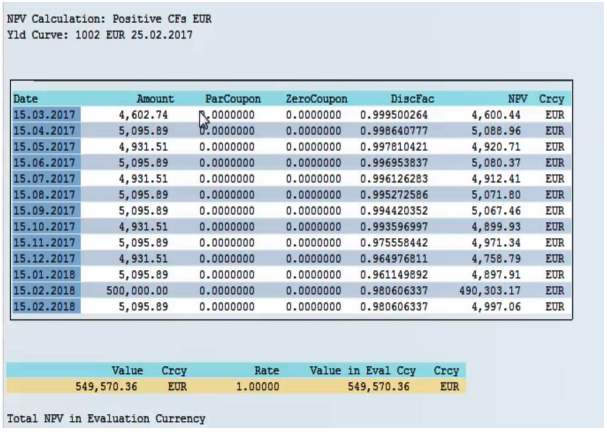

This transaction will be discounted based on the reference interest rates maintained on yield curve 1002.

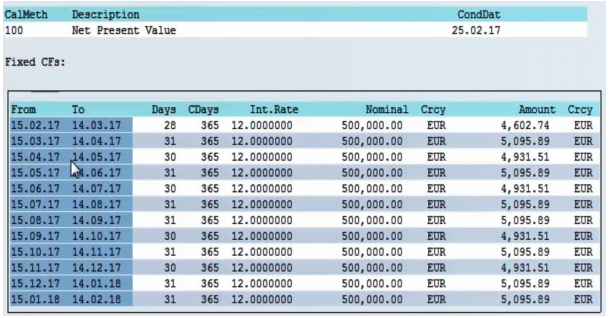

For detailed calculation parameters, click on the transaction again and select the icon Calculation Bases.

The Calculation Bases screen first shows the fixed cash-flows based on the fixed interest rate of 12% maintained on the transaction. The cash-flows are calculated based on the Interest calculation method specified on the transaction, Act/365 in this case. For the first cash-flow calculation would be: €500,000.00*12 %*( 28/365) =4602.74.

For the NPV Calculation, the system takes the Discounting Factor calculated based on the 1002 yield curve values and applies that to the fixed cash-flow. For the first line, the calculation would be:

€4602.74*0.9999500264= €4600.44

These discounted cash-flows are then added up and the total NPV of the transaction is €549,570.36.