The chief financial officer's central mandate has always been the safeguarding of an enterprise's financial health. In today's turbulent economic landscape, this duty faces increasing challenges. CFOs must grapple with emerging technology, complex supply chain issues, and shifting market conditions. In this environment, cash, the lifeblood of any business, can quickly become a liability if left unmanaged. A cash flow crisis is the modern CFO's worst nightmare, trapping an organization in a cycle of reactive firefighting.

The traditional approach to finance often leaves companies in a precarious position. Operational inefficiencies and fragmented data create a lack of visibility, making it impossible to see a crisis before it arrives. This report examines the symptoms of this traditional, reactive state and contrasts it with the new frontier of proactive command enabled by SAP S/4HANA.

The Old Fight: The Symptoms of Crisis

A reactive stance on cash management is characterized by a series of interconnected symptoms. These are not isolated problems but a cascade of failures stemming from a lack of control.

Symptom I: Delayed Debtor Payments

A business often operates on a "tightrope" between collecting from its customers and paying its suppliers. Slow-paying debtors, a direct result of poor Accounts Receivable management, create a persistent cash shortage. A business may have strong sales, yet find itself cash-poor because a significant portion of its revenue is tied up in outstanding invoices. This can be a symptom of inefficient invoicing, a fear of upsetting customers, or a lack of systematic collection processes. A non-paying or slow-paying customer can bring a business to its knees.

Symptom II: The Peril of Debt

A clear red flag for a cash crunch is increasing reliance on debt, not for strategic growth, but to cover day-to-day operational expenses like payroll. While debt can be a useful tool, relying on it to bridge gaps in revenue is unsustainable. This habit can quickly damage a business's credit rating, making it more challenging to secure financing in the future. It creates a cycle of borrowing that is difficult to manage, especially if revenue does not increase correspondingly.

Symptom III: Inaccurate Forecasting

A business cannot respond to a situation it cannot see coming. Poor financial forecasting is a major vulnerability, leaving an organization unprepared for market fluctuations, seasonal changes, or unexpected expenses. Many businesses rely on spreadsheets and manual estimates, which are prone to error and quickly become outdated. This approach is often rooted in hope rather than a realistic or slightly pessimistic view of what will happen. The further a forecast extends, the less reliable it becomes, which highlights the need for a system that can continuously update its projections based on real-time data.

The New Frontier: The Pivot to Proactive Command

The modern CFO's role has evolved. The focus is no longer just on survival and cost reduction. The new mandate is to increase agility and identify opportunities for success in a turbulent environment. This requires a pivot from a reactive, crisis-driven stance to a proactive one. The objective is to gain complete control over a company's cash. This control is enabled by a new generation of enterprise solutions that provide real-time visibility, predictive capabilities, and automation.

A closer look at these interconnected symptoms reveals a single root cause: the lack of a unified, automated system. Manual processes lead directly to poor collections and delayed payments. The resulting cash shortage necessitates taking on more debt to cover obligations, which creates a debt spiral. The inability to get an accurate, unified view of liquidity is a direct consequence of this disconnected data flow. The solution is not to fix each symptom in isolation, but to address the fundamental lack of a cohesive, integrated data environment.

This pivot also addresses the challenge of talent retention. By automating time-consuming, manual finance tasks, modern solutions free up finance professionals. This allows them to move from clerical, stressful, and error-prone work to strategic, value-added activities like accurate reporting, on-time analysis, and effective FX hedging programs. The system becomes a tool for professional empowerment and retention, not just a technical solution.

The S/4HANA Foundation: A Single Source of Truth

The pivot to cash flow control is not merely a process change; it is a fundamental architectural shift. The underlying technology of SAP S/4HANA provides the foundation for this transformation.

The Architectural Core: Universal Journal and In-Memory Computing

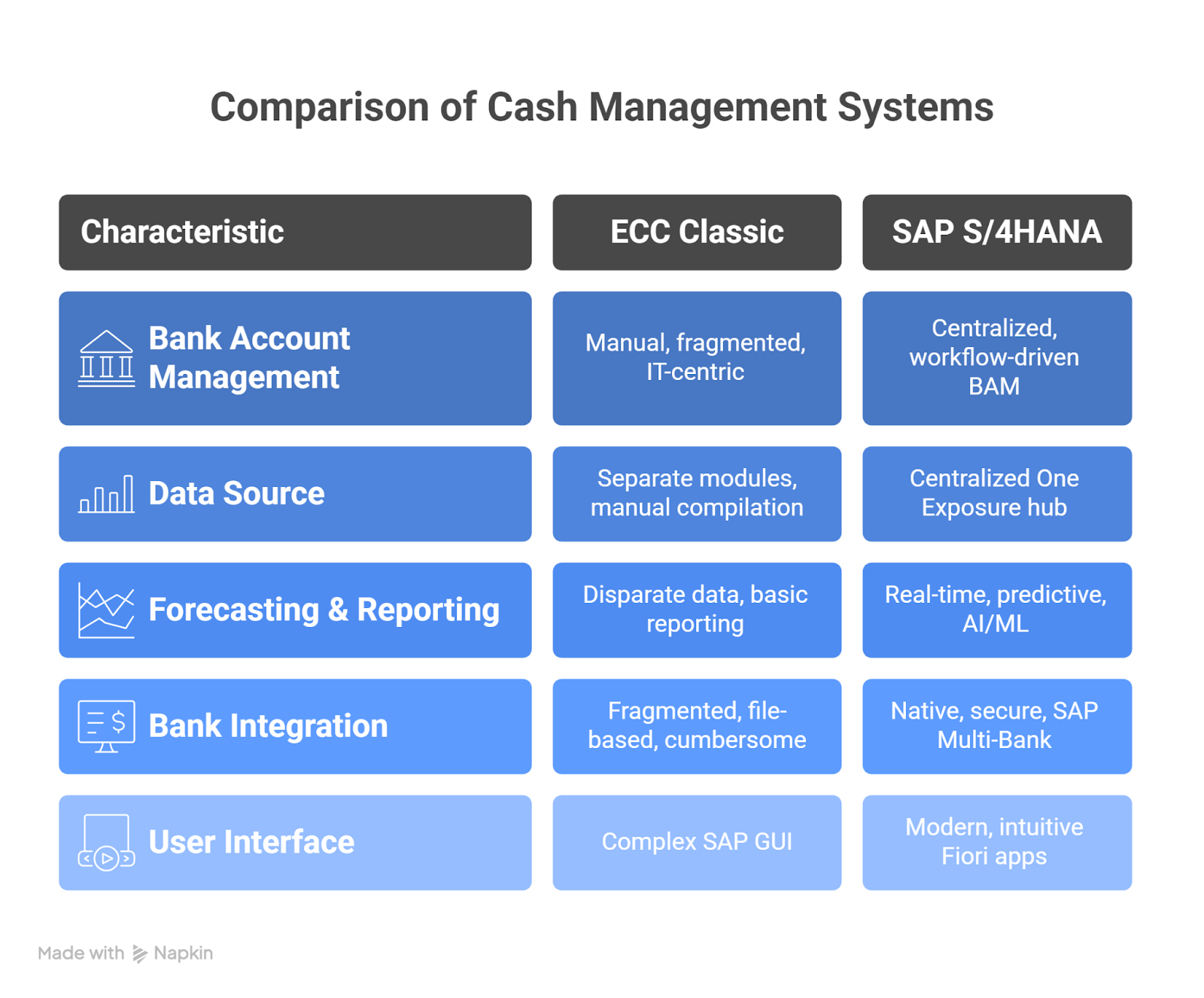

The technical breakthrough of SAP S/4HANA begins with its core architecture. Unlike the disparate, siloed tables of legacy ERP systems, S/4HANA is built on the SAP HANA in-memory computing platform and the Universal Journal, the ACDOCA table. This single, centralized table serves as the enterprise's "single source of truth."

The Universal Journal combines transactional line items from across different functional modules, including General Ledger, Controlling, Asset Accounting, and Material Ledger, into one physical location. This eliminates a major pain point of traditional systems: the need for time-consuming and often complex reconciliations between different ledgers and modules. This unification is a direct enabler of business agility. When financial leaders have instant access to accurate, unified data, they can respond to market shifts with speed and confidence. The technical architecture, with its clean core, directly enables the strategic business objective of enhanced agility.

The Liquidity Hub: One Exposure from Operations

While the Universal Journal unifies financial and controlling data, liquidity requires its own hub. S/4HANA introduces the One Exposure from Operations hub, a real-time center for all data relevant to cash and liquidity management. It aggregates information from Accounts Receivable, Accounts Payable, Sales & Distribution, and Treasury, ensuring accurate forecasting and risk management. Unlike ECC, where cash management was separate and data had to be compiled manually, S/4HANA tracks commitments in real time, making them instantly available.

A major shift is the move from IT-driven to user-driven processes. In legacy systems, bank account maintenance required IT transport processes. With Bank Account Management (BAM), changes can be made directly in production using structured workflows and monitored logs. This re-engineers finance by giving business users autonomy within a trusted data environment.

The table below compares the key functional differences between legacy and modern systems.

The Pillars of Control: Capabilities in Detail

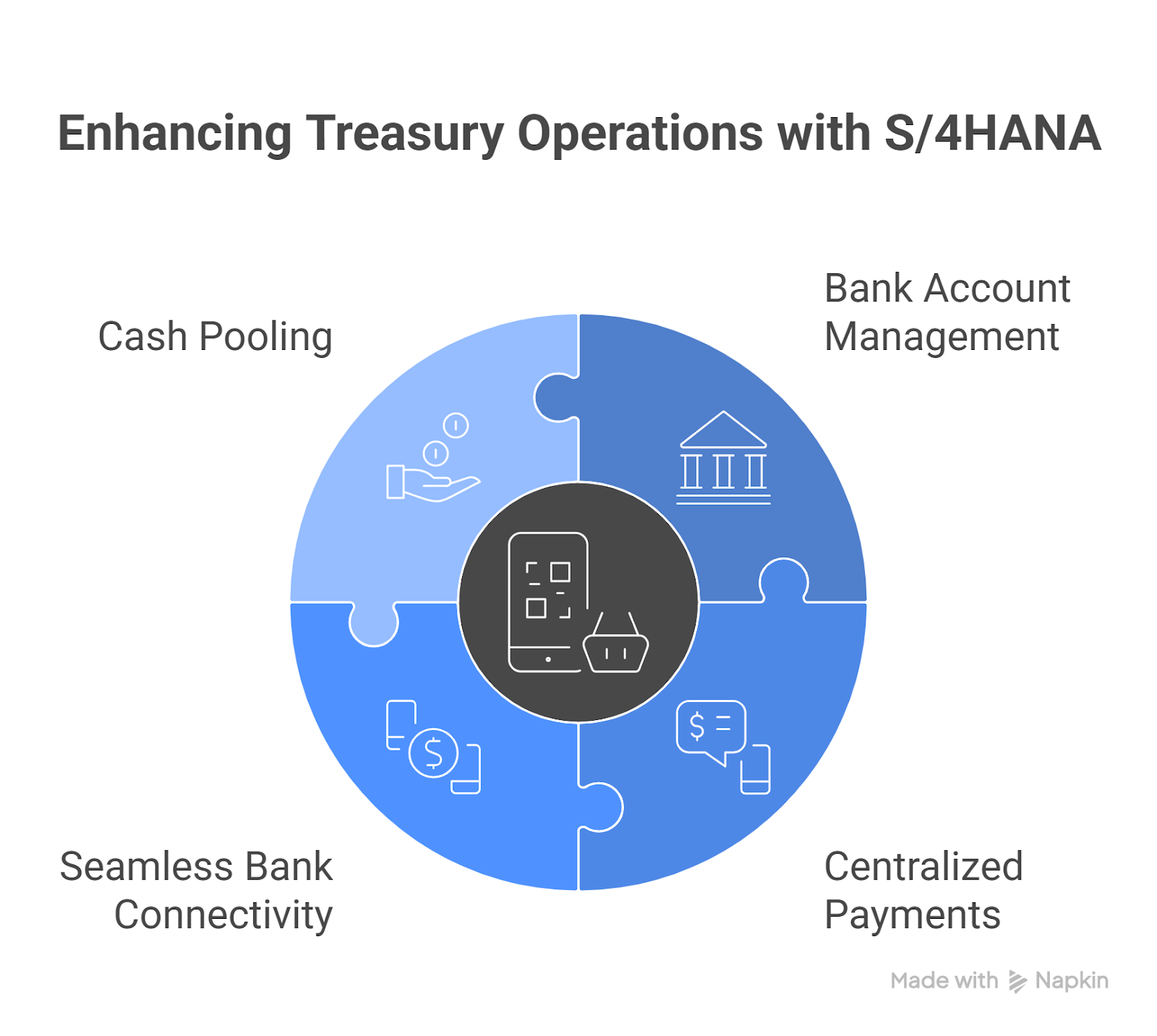

With the foundational architecture in place, S/4HANA builds a suite of capabilities that move an organization from reactive firefighting to proactive control. These capabilities span forecasting, operations, and user experience.

Precision Forecasting and Planning

S/4HANA moves beyond error-prone spreadsheets with an integrated approach to forecasting. Using the One Exposure from Operations hub, it generates short-term liquidity forecasts of up to 90 days based on payables, receivables, and memo records, while factoring in payment histories and terms.

AI and machine learning further improve accuracy by simulating scenarios, spotting patterns, and highlighting risks — shifting finance from a mere system of record to a system of intelligence. With Fiori apps turning raw data into insights, cash management becomes proactive rather than reactive.

Operational Command: Automation and Integration

S/4HANA's operational capabilities are centered on automation and seamless integration.

Bank Account Management (BAM): Centralizes the full bank account lifecycle with workflow-driven processes.

Centralized Payments: Streamlines payment operations via a single channel, enabled by SAP Multi-Bank Connectivity.

Seamless Bank Connectivity: Automates statement syncing and payment execution through secure cloud channels, reducing errors, improving compliance, and enhancing security.

Cash Pooling: Automates concentration and pooling to optimize interest income and lower borrowing costs, extending beyond traditional ZBA programs.

The Fiori Experience: Intuitive, Role-Based Access

The user interface for modern cash management is a significant departure from the complex GUI of legacy systems. S/4HANA uses a modern, intuitive, and role-based user interface via Fiori apps. These apps provide deep functionality and enhance the user experience by making cash data easily accessible across devices.

The Strategic Payoff: Efficiency, Agility, and Growth

The adoption of SAP S/4HANA for cash flow control delivers tangible, strategic benefits that go beyond simple cost savings. These benefits are evident in the experiences of companies that have already made the transition.

The ROI on Control: Tangible Business Benefits

The primary, demonstrable return on investment is the reduction of manual effort. A case study of an Indian tyre manufacturer, for example, showed that moving from Excel-based manual controls to an integrated SAP TRM solution eliminated duplicate data entry and manual reconciliations.

The true value is strategic, not merely tactical. By reducing the time and resources spent on low-value tasks, the system effectively creates capacity for the finance team. This newly available capacity can be redirected toward strategic initiatives like "enhancing execution of treasury" or "effectiveness of FX hedging programmes". An HVAC company that moved from ECC to S/4HANA reported enhanced productivity and better business insights, a direct result of standardized, integrated processes and a single source of truth.

This transformation turns the finance function from a back-office necessity into a front-line strategic partner. With real-time visibility and accurate forecasting, financial leaders can make more informed and faster decisions, whether it is optimizing cash reserves, managing liquidity risks, or planning for strategic investments.

Case Studies: Real-World Evidence

The move to SAP S/4HANA for cash flow control is a key part of a broader digital transformation. The benefits of this transition can be seen in various real-world scenarios.

The Tyre Manufacturer (PwC): This company, with all its treasury processes handled manually, implemented SAP TRM. The outcome was a streamlined, automated process for tracking debt and trade exposures, a user-friendly Fiori app for liquidity forecasting, and real-time month-end closing processes.

HVAC Manufacturer: This company moved from ECC to S/4HANA to address issues with disintegrated, manual processes and a lack of real-time data. The Greenfield deployment resulted in a single source of truth, enhanced productivity, and a reduction in costs.

Campbell Soup Company: While not a specific cash management case study, its cloud transformation with SAP systems resulted in improved data management, reduced downtime, and increased operational flexibility. This highlights that the implementation of S/4HANA for cash flow control is not a siloed project. The benefits of the foundational architecture—the single source of truth and process integration—enable subsequent improvements across the entire business. The cash management project serves as a strategic entry point for a wider organizational pivot.

The fundamental pivot from a Cash Flow Crisis characterized by delayed payments and inaccurate forecasting to Cash Flow Control is enabled by the architectural breakthrough of SAP S/4HANA. By providing a single source of truth through the Universal Journal and real-time data via the One Exposure from Operations hub, S/4HANA allows finance leaders to shift from reactive firefighting to proactive command, redirecting capacity toward strategic, value-added activities like accurate reporting and effective FX hedging programs.

Successfully implementing this level of integration and leveraging precision forecasting and automation requires specialized, senior-level expertise. ERPfixers stands as your necessary beacon of reliable SAP knowledge, founded to bridge the gap for those seeking quality, skilled, and immediate SAP solutions. Our team consists of top-tier thought leaders and seasoned SAP consultants specializing in Financials and Controlling in S/4HANA, providing the independent, practical advice to help your organization fully capitalize on S/4HANA’s capabilities. Whether you need help defining your S/4HANA Transitional Roadmap or optimizing operational control via centralized payments and BAM, we are committed to providing tangible results and ensuring seamless integration. Don't let complex SAP challenges hinder your financial transformation; partner with us to make your SAP processes agile and efficient and transform complexity into a competitive advantage. Schedule a meeting with one of our SAP experts today.

📧info@ERPfixers.com

📱+1 (207) 573-0486 x 800

▶️More great content on our YouTube Channel