For decades, SAP SE was the undisputed king of the General Ledger. For a finance department, SAP was the “system of record,” the digital fortress of debits and credits, and the home of familiar transactions like FBL1N and F-02. It was rock-solid, auditable, and the single source of truth.

But beginning in the mid-2000s, the role of the CFO started to evolve. The question CFOs were facing changed from “What happened?” (the domain of traditional ERP) to “What’s next?” and “Why isn’t this working faster?” In short: CFOs were becoming strategic business partners, not only record-keepers.

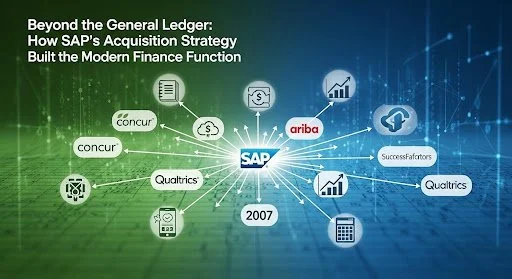

SAP’s core ERP addressed the first question extremely well but was ill-equipped for the next two. To bridge that gap, SAP embarked on a decades-long, multi-billion-dollar acquisition campaign. But this was not a scattered M&A effort, it was a methodical, deliberate campaign to buy into every function that modern finance must control.

Let’s examine four cornerstone acquisitions and then look at how SAP continues to expand this strategy today.

1. Business Objects SA (2007): The Leap to Analytics

The Problem: In the ECC era, finance reporting was rigid and slow. You ran standard reports, or waited for IT/ABAP to build custom ones. Historical, static, and reactive.

The Acquisition: SAP bought Business Objects, a leader in Business Intelligence (BI) and data visualization.

The “Why” for Finance: This was SAP’s answer to the CFO’s demand: “Don’t just store my data, let me understand it.” The shift: from static reporting to dynamic, self-service analytics. Finance teams could now slice, dice and visualise data on their own terms. This laid the groundwork for what today is SAP Analytics Cloud.

2. Ariba, Inc. (2012): Mastering Procurement and Spend

The Problem: SAP’s on-premise procurement module was a “walled garden.” Great at PO → invoice (MIRO) but blind to maverick spending, supplier risk, and strategic sourcing.

The Acquisition: SAP acquired Ariba, the largest B2B digital business network.

The “Why” for Finance: This extended SAP’s reach from Accounts Payable into the full procure-to-pay (P2P) lifecycle. For the CFO, that meant real-time spend visibility, upfront policy enforcement before an invoice hit the GL, and better supplier risk governance.

3. Concur Technologies, Inc. (2014): Taming Travel & Expense (T&E)

The Problem: T&E is notoriously a black hole in finance. Paper receipts, manual Excel, policy guesswork, frustrated employees and buried in AP data entry.

The Acquisition: SAP acquired Concur, the market leader in T&E automation.

The “Why” for Finance: This acquisition tackled one of the most painful manual processes in finance. It transformed T&E from a cost-center admin burden into a controlled, transparent, policy-driven reimbursement engine, freeing the AP team to focus on value, not data entry.

4. Signavio GmbH (2021): Optimizing the Process Itself

The Problem: By 2021 the finance team had analytics (via Business Objects), spend control (via Ariba), and T&E automation (via Concur). But the process question remained: “Why is everything taking 10 days?” Where are the bottlenecks in invoice approval, or the close process?

The Acquisition: SAP acquired Signavio, a leader in process mining and business process management.

The “Why” for Finance: This is the modern capstone. After buying systems for reporting, spend and reimbursement, SAP bought a tool to x-ray the processes themselves. That empowers finance to ask the “why” behind delays, to redesign end-to-end flows for speed and intelligence, not merely automate legacy processes.

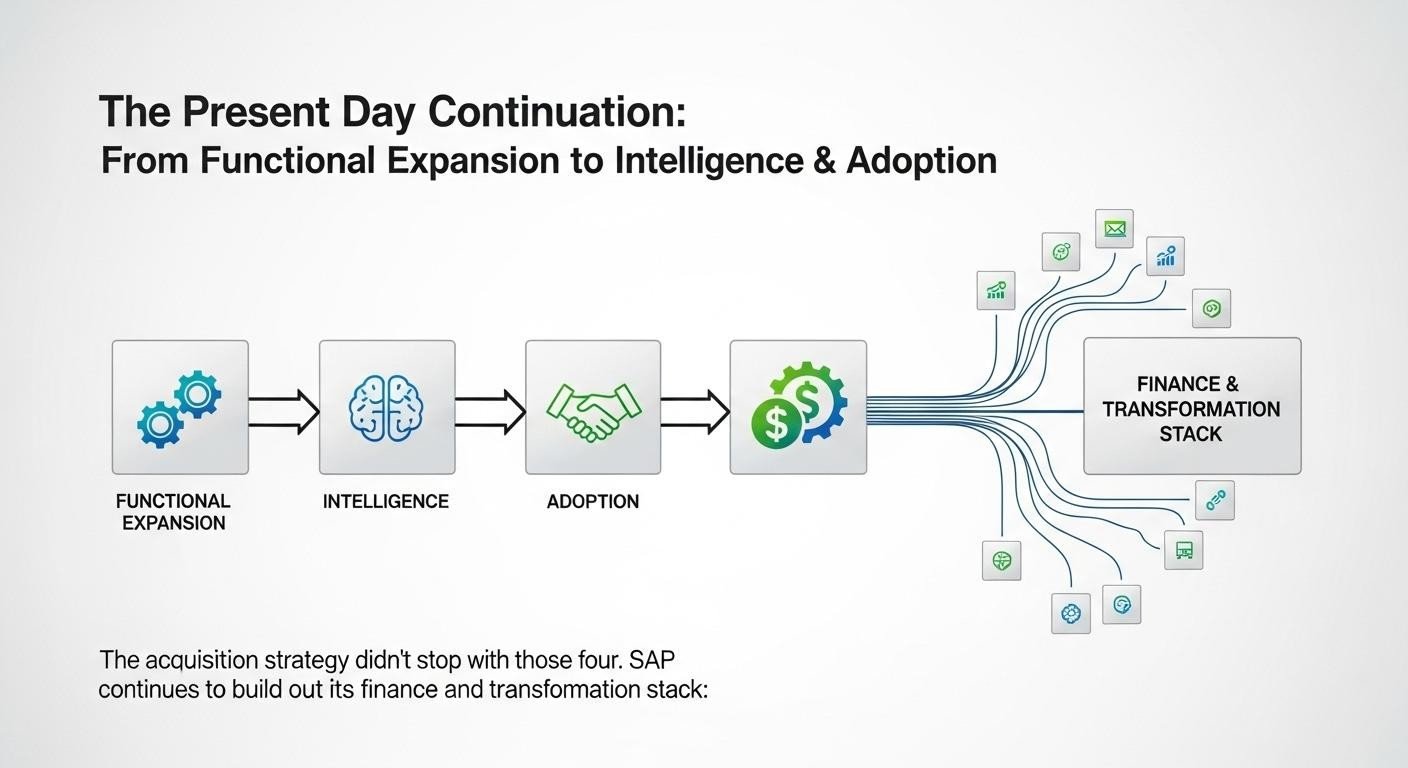

The Present Day Continuation: From Functional Expansion to Intelligence & Adoption

The acquisition strategy didn’t stop with those four. SAP continues to build out its finance and transformation stack:

● In June 2024 SAP announced the acquisition of WalkMe, Inc., a digital-adoption platform (DAP) provider, for approx. USD 1.5 billion. The rationale: to boost user adoption of solutions and workflows across applications.

● At the recent SAP Connect event (Oct 2025) SAP highlighted how its Business Transformation Management portfolio (including Signavio and others) is central to the “flywheel of AI, data & apps” that the modern enterprise must deploy.

● Recent releases of the Signavio suite show AI-driven capabilities (natural-language queries, larger-scale data integration, process mining enhancements) that strengthen the ‘why’ and ‘what next’ for finance functions.

Why This Matters for Finance Leaders

● From record-keeping to strategic partner: The modern CFO is expected to drive outcomes, not just report them. SAP’s acquisition strategy reflects this: moving from ledger to analytics, procurement/spend, process optimization and now adoption & intelligence.

● End-to-end visibility: “What happened?” is answered in the GL. “Why?” and “What’s next?” require layered capabilities analytics + process insight + system integration + adoption.

● Integration matters: Acquisitions only deliver value if they are embedded, interconnected and aligned with the CFO’s domain. The fact SAP is now enhancing AI, adoption and governance shows the next frontier.

● Time-to-value accelerates: With process-mining, AI-assistants, and integrated analytics, finance teams can shift from reactive to proactive.

● Governance + control as strategic levers: Modern finance doesn’t just aggregate data, it manages spend before it hits the GL, enforces policy real-time, and redesigns slow processes.

That evolution is not just historical, it’s current. The announcements in late 2023-25 show SAP is now shifting from “assemble the stack” to “operationalise the stack” (i.e., drive adoption, infuse AI, deliver measurable business outcomes).

For finance leaders, the takeaway: the modern ERP or finance architecture isn’t just about the GL anymore, it’s about control, insight, process, action and adoption. And SAP’s acquisition path reflects that.

ERPfixers stands as your trusted beacon of reliable SAP expertise—founded to bridge the gap for those seeking skilled, immediate, and high-quality SAP solutions.

Our team is composed of top-tier thought leaders and seasoned consultants specializing across all major SAP modules, with particular strength in Financials and Controlling (FI/CO) in S/4HANA. Many of our experts are also published authors on key SAP topics.

We provide tailored, actionable guidance to help you optimize processes, streamline implementations, and transform complexity into competitive advantage.

Don’t let SAP challenges slow your transformation. Partner with ERPfixers to make your SAP landscape more agile, efficient, and future-ready.

📧info@ERPfixers.com

📱+1 (207) 573-0486 x 800

▶️Follow us on LinkedIn