“AI” is the biggest buzzword in tech today, but for finance teams on the ground, it often still feels … abstract. How does AI actually help an accountant close the books, or an AP specialist process an invoice with less pain?

With the Q3 2025 updates, SAP is finally moving “Business AI” from a PowerPoint slide to a practical, everyday tool. These new features, many of which are now in General Availability for S/4HANA Cloud, are designed to automate low-value tasks and provide instant, intelligent insights. Let’s break down the most impactful new AI features for finance teams.

1. For Accounts Payable: Conversational ERP is Here

The AP department is getting two of the biggest upgrades.

Joule for Supplier Invoice Verification (GA)

Via Joule, an accountant can now use natural-language prompts to ask questions such as:

● “What is the payment status of invoice 19000087?”

● “Who is the current approver for this invoice?”

● “Release the payment block for invoice 19000088.”

The era of hunting through FB03, ME23N, workflow logs and multiple screens is being replaced with conversational access to the ERP. SAP estimates up to a ~60 % reduction in time needed to find invoice details. This is a major step toward “conversational ERP” for finance teams.

AI-Assisted Payment Exception Analysis (Beta)

Every AP team knows the pain of a failed payment run: trying to track down the root cause through complex logs, approvals, system errors, bank rejections, etc. With this new Beta feature, AI examines payment-run logs, identifies root-cause patterns (e.g., vendor bank mismatch, currency block, approval chain missing) and surfaces an explanation in plain language. That means faster resolution of exceptions, improved on-time payment rates, and fewer surprises come month-end.

2. For Controllers & Cost-Accountants: The Magic “Why” Button

Two of the traditionally complex areas in finance are getting a dose of simplicity.

AI-Assisted Explanation of Fixed Asset Key Figures (GA)

Asset accounting has long been a sort of “black box”, depreciation rules, revaluations, impairment logic, inter-company transfers, you name it. With this capability, the asset accountant can hit an “Explain” button (via Joule) and get a natural-language explanation of how an asset’s value was calculated: e.g., “Because the asset was transferred on 01-Apr for €2 m at scrap value, straight-line depreciation over 20 yrs, residual value of 10 % … that leads to the book value of €1.85 m as of 30 Sept.” That means fewer auditor queries, more transparency, and quicker responses.

Joule for Costing Variant Explanation (GA)

Similarly, product costing (costing variants, costing run results, overhead absorption, etc.) has always been tricky for cost accountants to explain. With this feature, a cost accountant can ask: “Why did product ABC’s standard cost increase by 8 % compared to last period?” Joule will walk through the drivers (higher labour rate in region X, increased scrap rate, changed overhead driver base) and show which costing parameter caused the change. This significantly cuts troubleshooting time and helps select the right costing variant faster.

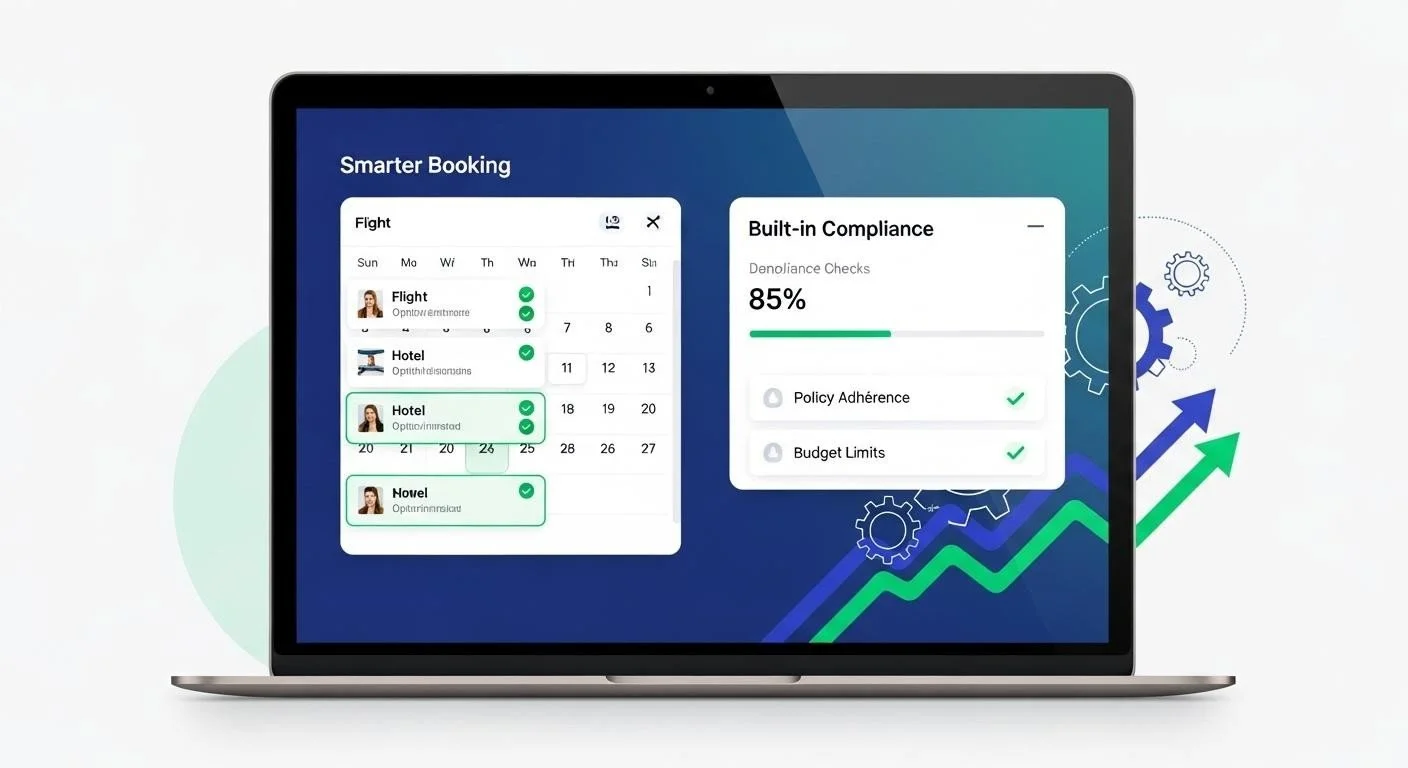

3. For Spend Management: Smarter Booking, Built-in Compliance

The new AI features aren’t just for S/4HANA, the spend side is also getting smarter.

Booking Agent with Joule in Concur Travel (Early Adopter)

In the travel & expense (T&E) space, the “Booking Agent” acts as a smart, personal travel assistant. A business traveler could say: “I need to fly to our Chicago office next Tuesday for two days, and I prefer a morning flight.” The Booking Agent analyses the employee’s preferences, the company’s travel policy, and approved budget to recommend flight + hotel options that meet policy and optimize cost/comfort. This is a win for the traveler (fast, consumer-grade experience) and the CFO (policy compliance, spend predictability, fewer after-the-fact approvals).

4. The Broader AI Platform Picture & What’s Coming

This quarter’s updates reflect a broader strategy from SAP, under the banner of “Business AI”, to embed intelligence into every business process. For example:

● SAP is setting up an AI Foundation on the SAP Business Technology Platform (BTP) that supports agents, generative AI, a knowledge graph, and low-code Joule Studio.

● SAP achieved ISO 42001 certification for AI governance, meaning customers can have greater trust in the ethics, security and compliance of these AI solutions.

● The roadmap shows more “agentic AI” autonomous agents that can act across systems and processes, not just respond to prompts.

● In finance specifically, beyond what we’ve covered, SAP mentions “Joule mass updates” (e.g., mass invoice changes via natural language) and “AI document extraction for quality-certificates” as coming innovations.

5. What These Updates Mean for AP, Asset Accounting & T&E

For AP Teams:

● Reduced manual search / navigation means faster processing and fewer bottlenecks.

● Payment-exception AI means fewer manual investigations and higher payment-on-time rates.

● Conversational interface lowers training barrier, more casual users (e.g., shared services) can get up-to-speed faster.

● But: Implementation will still require clean-master-data (vendors, bank info, invoice metadata) and change-management to adopt conversational processes..

For Asset Accounting / Cost Accounting:

● The “explain” features mean fewer auditor queries, faster month-end close cycles, and more transparency for stakeholders.

● Cost accountants gain self-service insight into why variances occur, reducing reliance on IT or external consultants.

● However: These features depend on consistent costing models, correct parametrics, and documentation, so enterprises need to ensure data discipline.

For T&E / Spend Management:

● The Booking Agent shifts spend from after-the-fact to pre-booking compliance, which means fewer policy breaches and fewer after-the-fact corrections.

● This could drive both cost savings (better rates, fewer manual approvals) and improved employee satisfaction (faster booking).

● That said: Early-adopter status means organisations need to manage change: training travel teams, aligning policy logic, and checking whether the “recommendations” truly align with business needs (flexibility vs cost).

6. What to Ask & Do Now (for Finance Leaders)

If you’re a CFO, finance director or head of shared services, here are actions to consider:

● Inventory your use-cases: Which parts of your finance/operations process are still manual, search-intensive, or waiting on IT? AP, fixed assets, costing runs, T&E booking are strong candidates.

● Check your data readiness: Conversational AI and “explain” features assume clean master data (vendors, assets, cost-variants), consistent models, and traceability.

● Pilot with business users: The early gains may come from conversational access (what used to take 10 minutes can take 30 seconds). Run a pilot in your AP Shared Service Centre or asset-accounting team.

● Change-management is key: The interface changes (natural language prompts, AI-generated explanations) mean you’ll need to retrain users, reset expectations, and update governance (who can ask what, what are the escalation paths).

● Embed governance and audit-readiness: With more AI doing root-cause analysis or generating explanations, ensure there is transparency (how did the AI reach that conclusion), audit trail, and controls around AI-enabled decisions. The ISO 42001 certification is a positive sign here.

● Monitor adoption and value metrics: Use dashboards to track how many users are leveraging conversational prompts, how many exceptions are resolved via AI, how much time is saved. The SAP roadmap identifies usage metrics for Joule as an upcoming capability.

7. Final Word: From Data Entry to Data Insights

The Q3 2025 AI updates from SAP aren’t about replacing finance professionals. They’re about augmenting them. They automate the most tedious, low-value parts of the job, searching, root-cause analysis, data-entry, so finance teams can focus on higher-value, strategic work: analytics, advisory, decision-making.

As finance teams move from “data entry and reconciliation” to “data insights and influence”, AI becomes a key enabler of that evolution. If you’re still asking “how will AI impact my finance team?” the answer now is clearer: invoices, exceptions, assets, costing, travel. Start there, see quick wins, build adoption and you’ll steadily move toward a more intelligent finance organisation.

ERPfixers stands as your trusted beacon of reliable SAP expertise—founded to bridge the gap for those seeking skilled, immediate, and high-quality SAP solutions.

Our team is composed of top-tier thought leaders and seasoned consultants specializing across all major SAP modules, with particular strength in Financials and Controlling (FI/CO) in S/4HANA. Many of our experts are also published authors on key SAP topics.

We provide tailored, actionable guidance to help you optimize processes, streamline implementations, and transform complexity into competitive advantage.

Don’t let SAP challenges slow your transformation. Partner with ERPfixers to make your SAP landscape more agile, efficient, and future-ready.

📧info@ERPfixers.com

📱+1 (207) 573-0486 x 800

▶️Follow us on LinkedIn