SAP S/4 HANA Financial Closing – An overview.

Abstract:

The year-end close process is one of the important activities of companies. End users spend most of the time on reconciliations, collecting and validating the data from different components of the same company code or multiple company codes reconciling intercompany activities, reconciling accounts, and making necessary adjustments, finally producing the financial statements. Even today many companies are following outdated & poor closing processes using excel sheets. This paper is aimed to provide an overview on closing processes in SAP S/4 HANA, so companies can shorten the Accounting close and helps faster decision making.

Introduction:

During “Closing the books or Financial Close” Accounting executives verify books of Accounts and their accuracy. This is necessary to validate the integrity of each transaction and account balances on the company’s balance sheet. This is one of the processes in Financial close. SAP S/4 HANA Finance – Universal Journal Entry table fills data from General Ledger Accounting, Controlling, Material Ledger, Profitability Analysis and Asset Accounting, Accounting Executives do not require to compares balances and transactions, and identifies discrepancies during period end or Year-end as data posts in single table (ACDOCA). SAP S/4 HANA Controls and Automates certain closing activities. Universal Journal Entry table is single source of truth and it ensure that reconciliation of FI-AA, FI-CO etc.

I would like to provide an overview on Closing activities that are available in SAP S/4 HANA 1809. I felt, it is important for three reasons mainly:

Volatility increased pressure on everyone to report performance timely, completely, and accurately to stakeholders.

Helps accounting departments of SAP S/4 HANA Customers to reduce workload at period end and year end, thus negative impact on efficiency of the close process reduces.

Thirdly, it controls weaknesses related to the financial close process and enhances collaboration among multiple departments that leads to ability to incorporate new regulations – in the financial close process. Finally, improves effectiveness and efficiency of the financial close process.

Overview:

Period end and year-end closing in Financial Accounting

Closing Activities in Fixed and Current Assets:

Closing activities Receivables and Payables

Technical, Organizational, and Documentary Closing Activities

SAP Financial Closing Cockpit

1. Period end and year-end closing in Financial Accounting:

The pre-closing activities on the last day of month are as follows:

Process purchase order accruals, enter manual accruals and deferrals, process recurring entries Etc. Maintain the goods receipt and invoice receipt (GR/IR) clearing account, and post material revaluations. Post payroll expenses in HCM, Post goods issues for deliveries in SD, perform allocations and reposting in Management Accounting, then Lock the old accounting period.

Open a new accounting period in Financial Accounting in OB52. on the specified date in the current period close the previous month. The same Process in Materials Management (MM) in Transaction MMPV

2. Closing Activities in Fixed and Current Assets: (New Asset Accounting and Inventory)

New Asset Accounting: During year-end closing below steps are performed

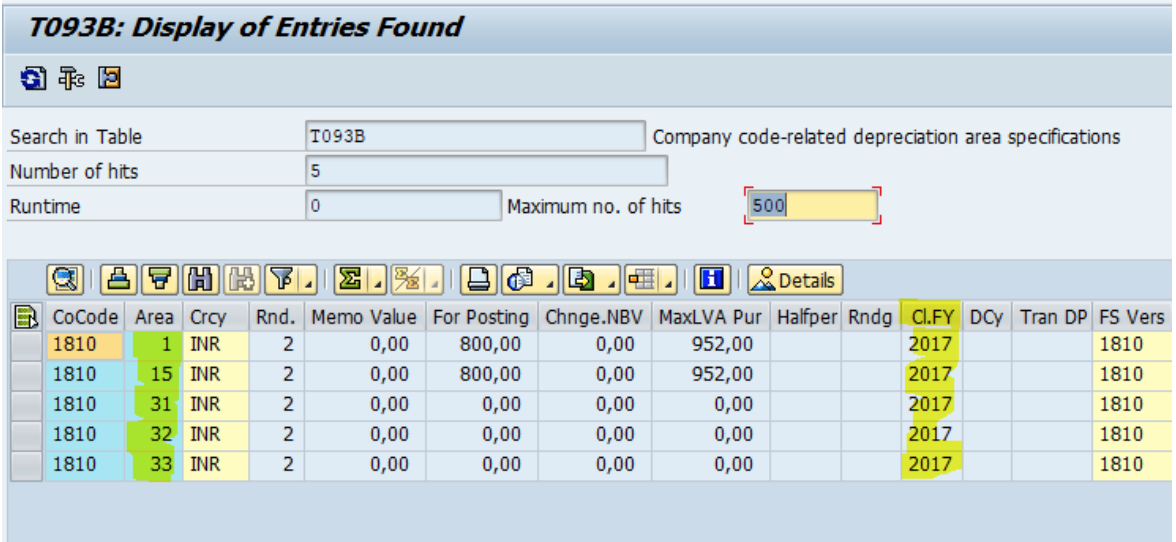

The fiscal year change in Asset Accounting is carried out using Transaction code FAGLGVTR.

During Execution of FAGLGVTR, G/L balance carryforward, the asset values from the old fiscal year are cumulatively carried forward to the new fiscal year. From this point on, you can make asset postings in the new fiscal year. At the same time, you can continue to make postings to the old fiscal year

Fiscal Year-End Program

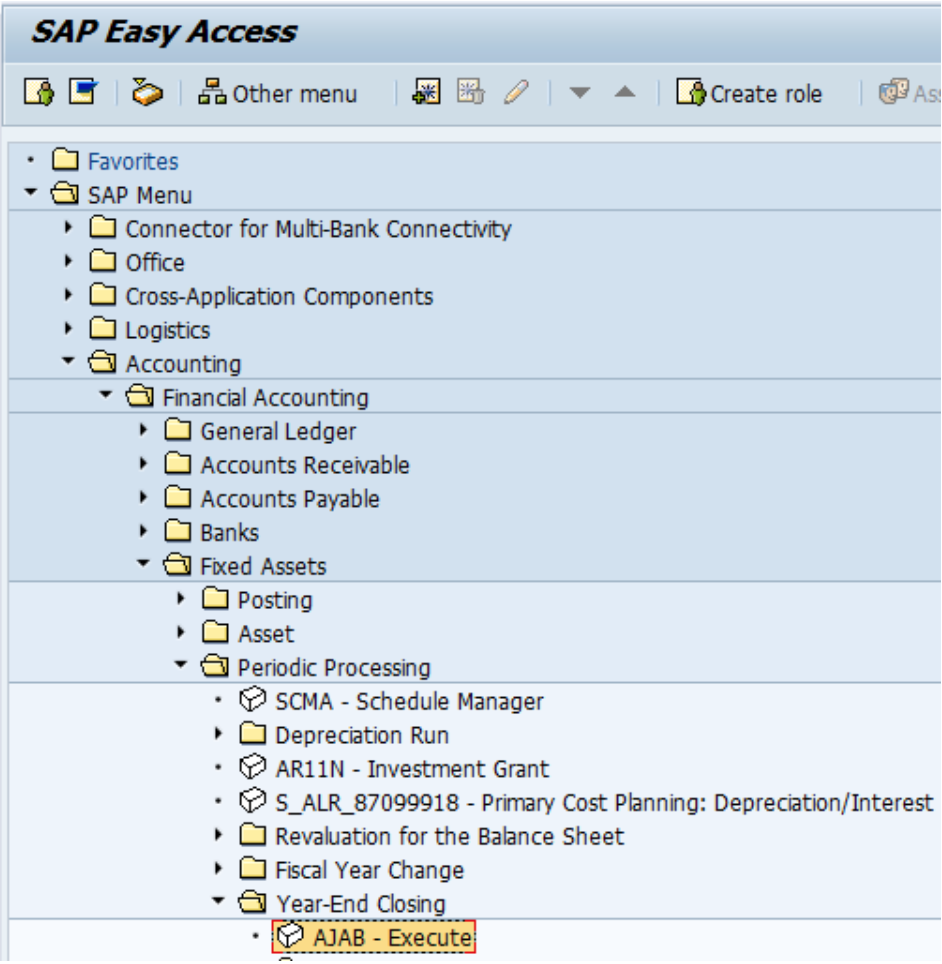

Year-end closing program can be found in the SAP Easy Access menu.

Accounting > Financial Accounting > Fixed Assets → Periodic Processing → Year-End Closing → Execute.

Transaction Code AJAB

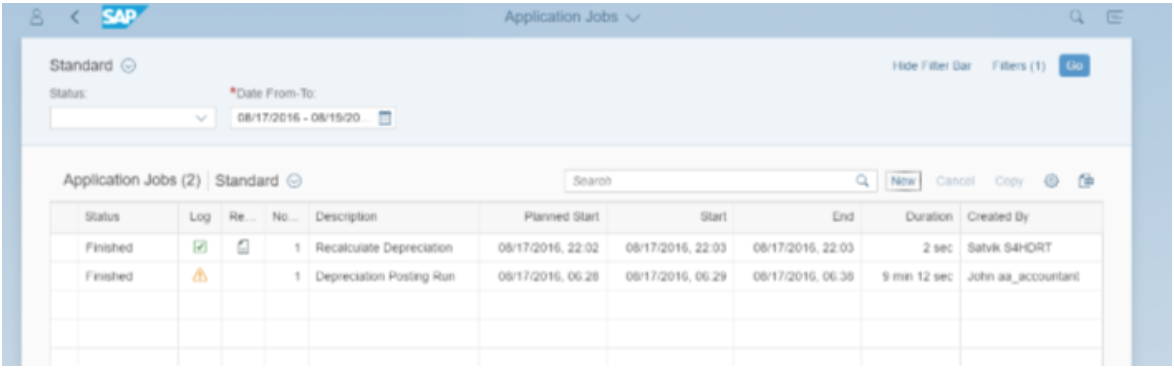

You can execute the year-end closing program using the SAP Fiori app “Schedule Asset Accounting Jobs”

If the program does not find any errors, it updates the last closed fiscal year for each depreciation area. The program also locks all closed fiscal years against postings from the asset area.

If a closed fiscal year is then released for posting, it can be closed again only after the year-end closing program has been run again.

Goods Receipt and Invoice Receipt Postings

The three-step reconciliation procedure is as below

Purchase order: There is no data posted in FI.

Goods receipt : To update the inventory, a material document is created in MM. At the same time, a document is created in FI

Invoice receipt : The vendor invoice is posted in MM. At the same time, a document is created in FI.

The last two steps can be completed in reverse order, The GR/IR accounts indicate whether goods were received for each invoice and vice versa.

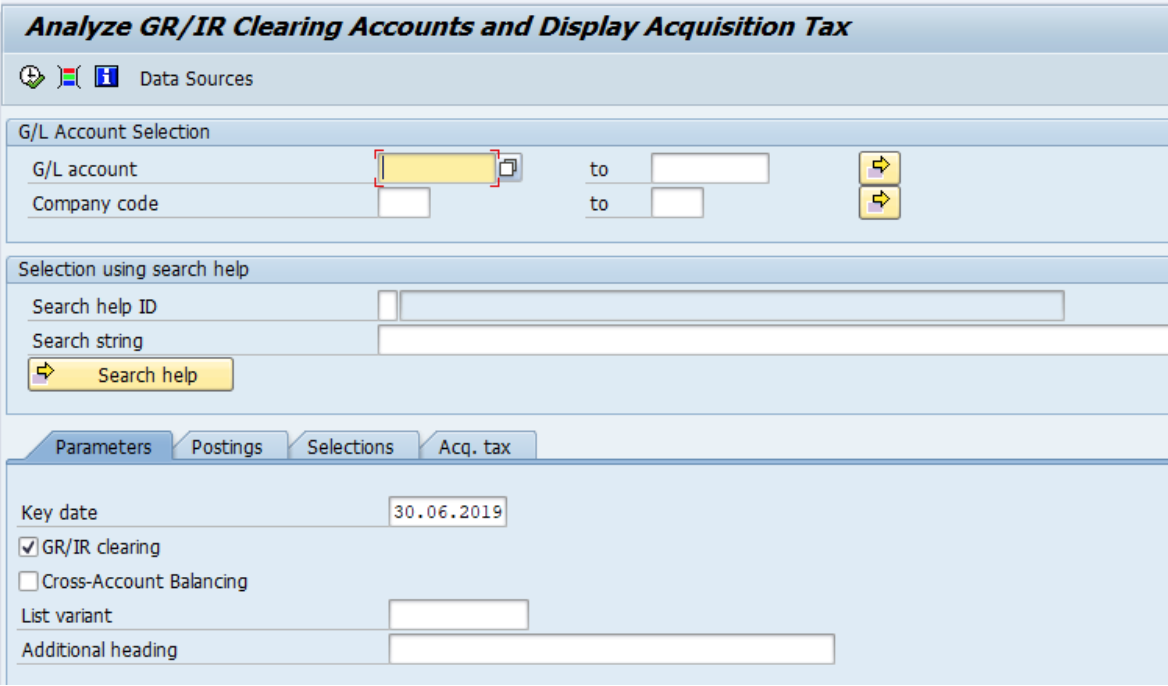

Maintenance of Goods Receipt and Invoice Receipt Clearing Accounts

The GR/IR clearing account is maintained in MM when the quantity of a material Received differs from the quantity invoiced. Closing activities in FI also involve analyzing the GR/IR clearing account and ensuring that the balance is zero . Typically, It is recommended to execute it on monthly basis.

The GR/IR clearing account records all the goods Receipt and invoice Receipts for every purchase order. The GR/IR clearing account and its adjustment account are contained in the appendix to the balance sheet.

Stock Valuation

Material Type

Valuation

Raw materials, supplies, and consumables

These stocks will be procured externally, they are managed with a moving average price. The value for them will be calculated from the current moving average price.

Work in process

These stocks are produced internally, they are valuated with a standard price. Additional steps will be carried out to see WIP on Balance Sheet

Finished goods

These stocks are goods manufactured in-house. The value is calculated from the stock quantity and the standard price of the goods.

The following activities are performed during stock valuation for Raw materials, supplies, and consumables:

Balance sheet valuation

You can evaluate stocks for the balance sheet in the following ways:

Lowest value determination according to current market prices

Lowest value determination according to the rate of movement and range of coverage

You can use the methods separately (single-level procedure) or in combination (multilevel procedure).

Work in process

WIP Stock Valuation Procedure

The procedure for WIP stock valuation is as follows:

WIP is calculated on the key date.

The settlement of the production order displays value of WIP on the balance sheet.

After the balance sheet key date, the production order will be confirmed and settled. This cancels WIP and the key date posting is reversed in the subsequent period. The balance sheet displays value of finished products. At the same time, the production order will be credited.

You can calculate the WIP on the basis of either actual costs incurred for the order, or target costs for completed transactions, based on the type of production order.

Stock Valuation: Finished Products

The process for the stock valuation of finished products is as follows:

Costing run

When costing a material with a quantity structure (CK11N), use costing variant to determine whether the costing run refers to tax or book inventory costing.

Value determination or price update

Specify in Customizing how the values are determined and where the costing results are updated.

Revaluation of total

If the material master does not have the updated standard price, you can choose transaction MRN9 to post the valuation differences

Closing Activities Receivables and Payables

Receivables and payables accounts closing consists of the following activities:

At the beginning of the New fiscal year, balance carryforward program carrying forwards the balances of the customer and vendor accounts. However, you can choose to perform balance carryforward separately for vendor and customer accounts. Balance confirmations will be generated, foreign currencies valuated, Accounts receivables and Accounts Payables will be regrouped.

Balance confirmations, including reply slips, are automatically created for customers and vendors. A reconciliation list and a results table are also created.

Balance confirmations and reply slips will be sent to the customers or vendors and the lists are forwarded to a control center. The customers or vendors check the balance information they receive and send their reply to the control center. The replies are compared to the reconciliation list and the results are entered in the result list.

You can use SAP Fiori apps :

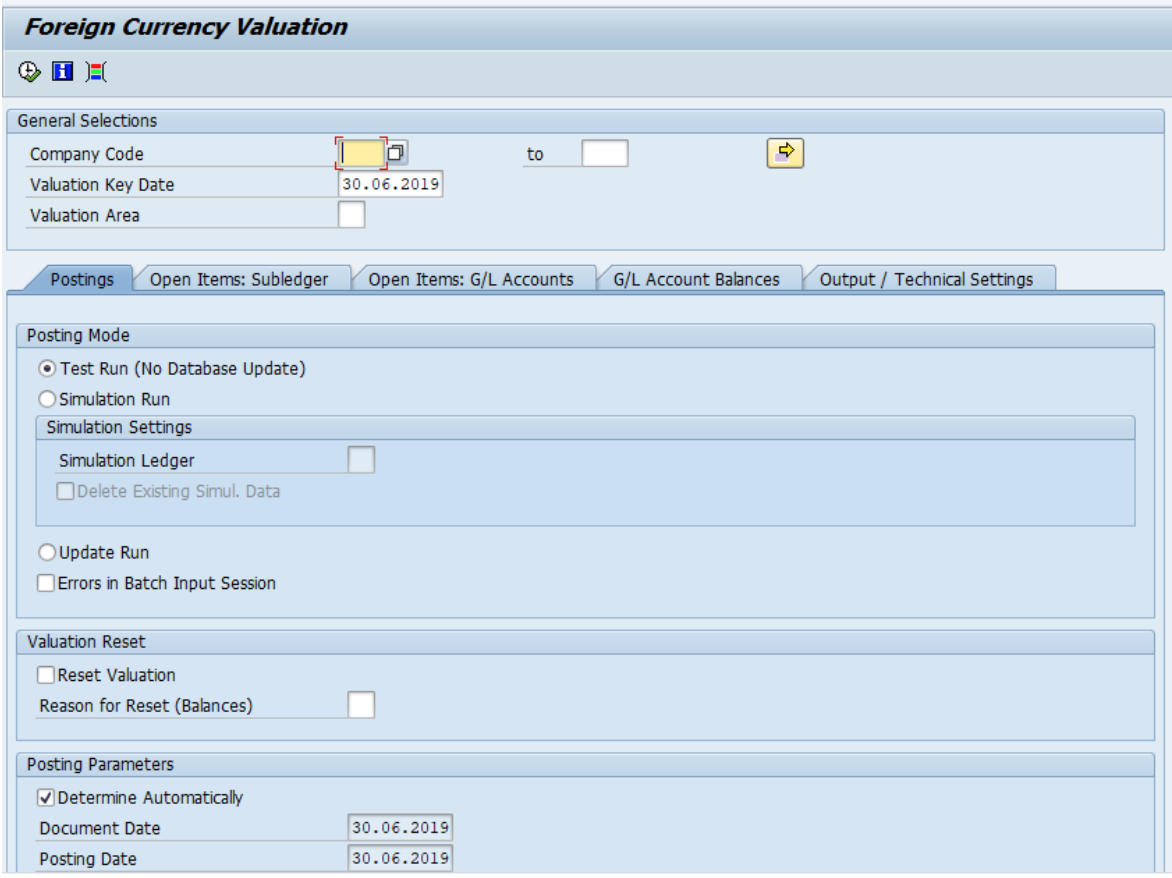

Foreign currency valuation of open items

Report FAGL_FCV valuates open items in the foreign currency as well as open items in the foreign currency balance sheet accounts.

The posting document generated by the foreign currency program is reversed automatically with the same program, on the first day of the next month.

If you do not want to reverse the valuation postings during open item valuation, you must make additional configurations for using the delta posting logic.

Technical Steps During the Period-End Closing Activities

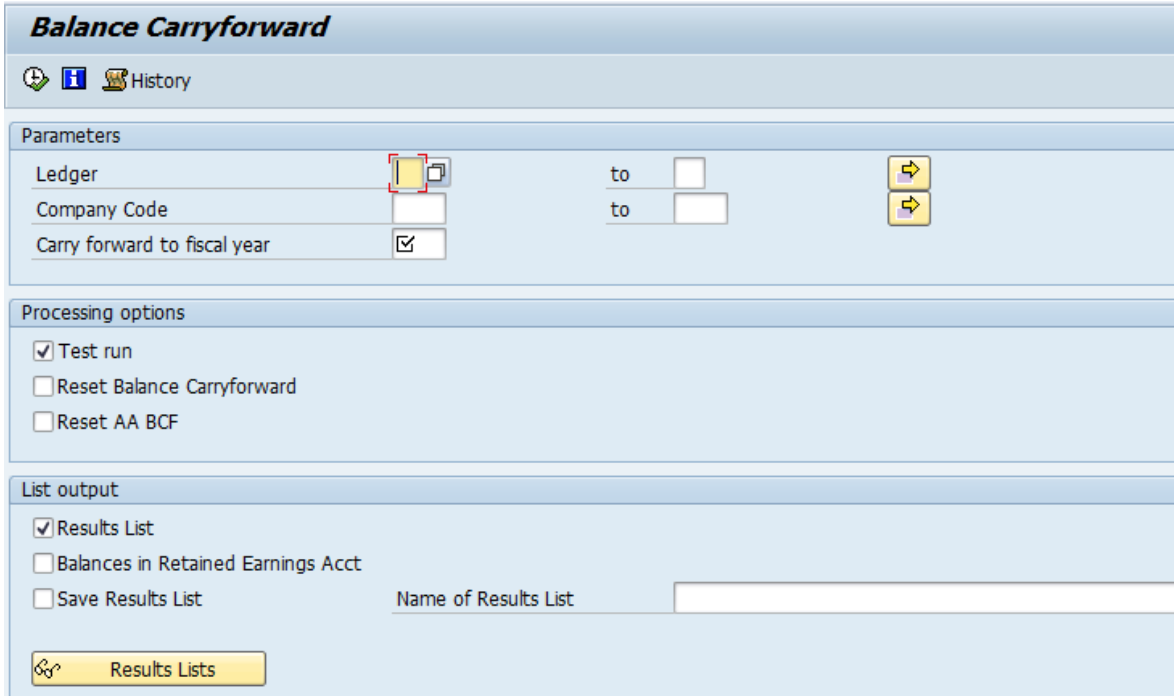

At the beginning of the fiscal year, the balance Carryforward program will be executed. This step carries forward the balances of the general ledger, AR , AP, and asset accounts to the next fiscal year. The posting periods of the old fiscal year are blocked and special periods for closing postings will be opened. Foreign currency documents are valuated, accruals are performed, and the GR/IR clearing accounts are analyzed, including regrouping of the balance. When this exercise complete, the special periods will be closed. Then balance audit trail is executed, and the financial statement created.

Balance Carryforward will be executed for :

Balance sheet accounts and customer and vendor accounts

Profit and loss accounts

Fixed asset accounts

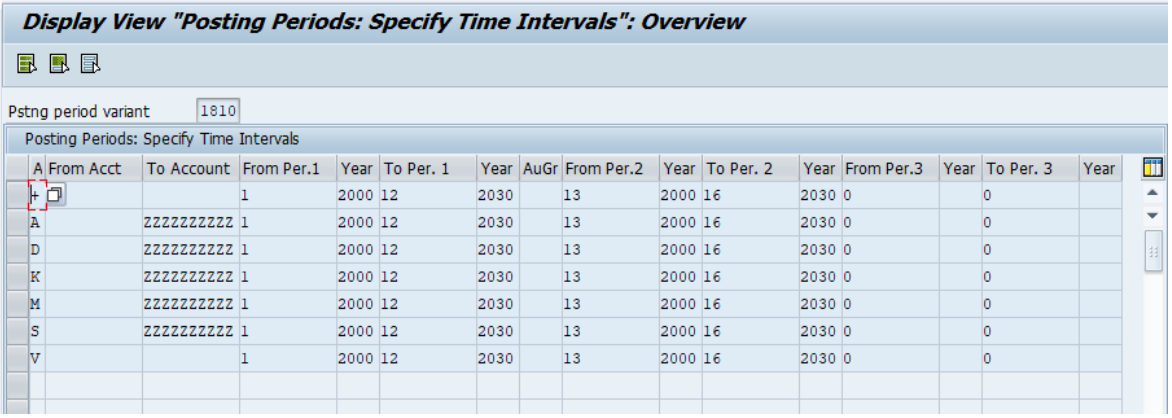

Posting Periods

The posting periods for your company are defined by the fiscal year variant.

Posting Period Control

Accounts are open for the periods specified in the table and closed for periods not specified.

Transaction Code : OB52 Or FAGL_EHP4_T001B_COFI

The line with account type + (valid for all accounts) determines the maximum length of the open periods for an account type.

In the additional lines with the individual account types (A, D, and so on), the number of open periods for the accounts specified is restricted.

In SAP S/4HANA period interval 3 is used for postings from Controlling (CO) to Financial Accounting (FI). If this third interval is not filled, the entries in intervals 1 and 2 are also valid for these postings.

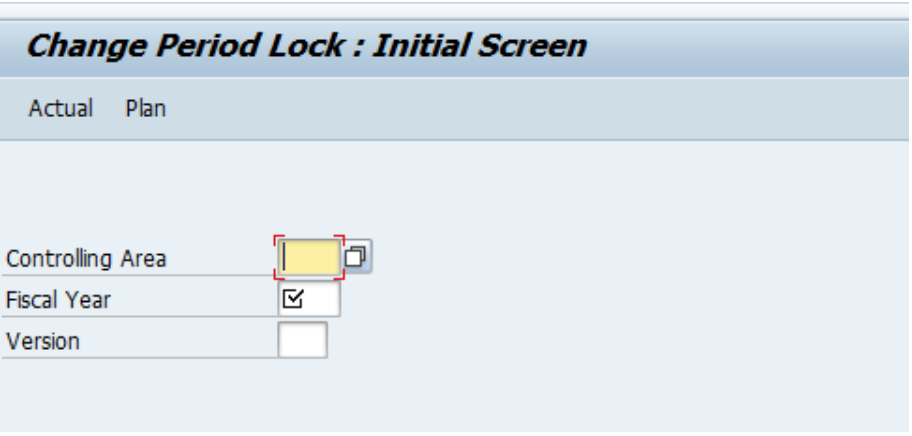

Controlling period lock : OKP1

Balance Audit Trail

A balance audit trail generates compact journal for a specified period in the form of a list. The balance audit trail displays balance at beginning of a period and then changes to the account balance at the period end.

You can execute Balance Audit Trail using an app or Transaction code shown below:

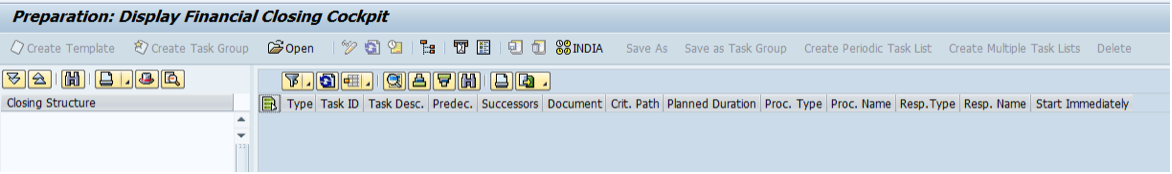

SAP S/4HANA Financial Closing Cockpit

To manage the closing processes better, Accounting Team may be looking for a structured interface to execute transactions and programs that form part of such complex processes. In SAP S/4 HANA, you will have Financial Closing Cockpit. It is an application that enables Accounting team to create a structured interface for executing transactions and programs. The structural layout supports processes within company code and multiple Company codes. It allows all Accounting team to set a manual status for a task. To get an overview of the status of the closing process, the task list allows them to access status information, issues related to tasks, and any job logs, spool lists, or application logs created by the system during task execution. This information is available for all tasks executed automatically or manually.

Financial Closing Cockpit Configuration

1. Create a template

Create a uniform template for the closing process.

Schedule the entire process chain.

2. Create tasks

Define individual activities based on chronological sequence in org. structures.

Structure transactions and programs.

Define dependencies.

Define upstream programs and transactions for the program in the template.

Define program sequences in the preceding task relationship.

3. Create a task list

Derive concrete task lists from the template, including parameter settings for variables of program variants.

Convert the template to task lists.

4. Release the task list

Transfer the configured task list to application.

Maintain a status for the executability of the task list.

To run programs included in a task list, you need to specify variant values. The task list generated from the template automatically updates the time-related program parameters of the selection variants by entering corresponding header information in the task list.

The transaction FCLOCOT supports working division between the closing planner at group level and person responsible for closing at local level.

Conclusions:

Temporary glitches or ongoing problems can be brought to minimum using SAP S/4 HANA closing processes. It helps in avoiding too many manual closing processes, excel sheets work and enhances accuracy in operating & Financial results.